{{First_Name|Explorer}}, welcome back!🚀

Commerce and defense sector in space saw a lot of updates this week and an interesting report on what “Commercial” Space means in US vs. European space procurement. Click the link below to read the unclipped publication. ↓

Read on.

IMAGES

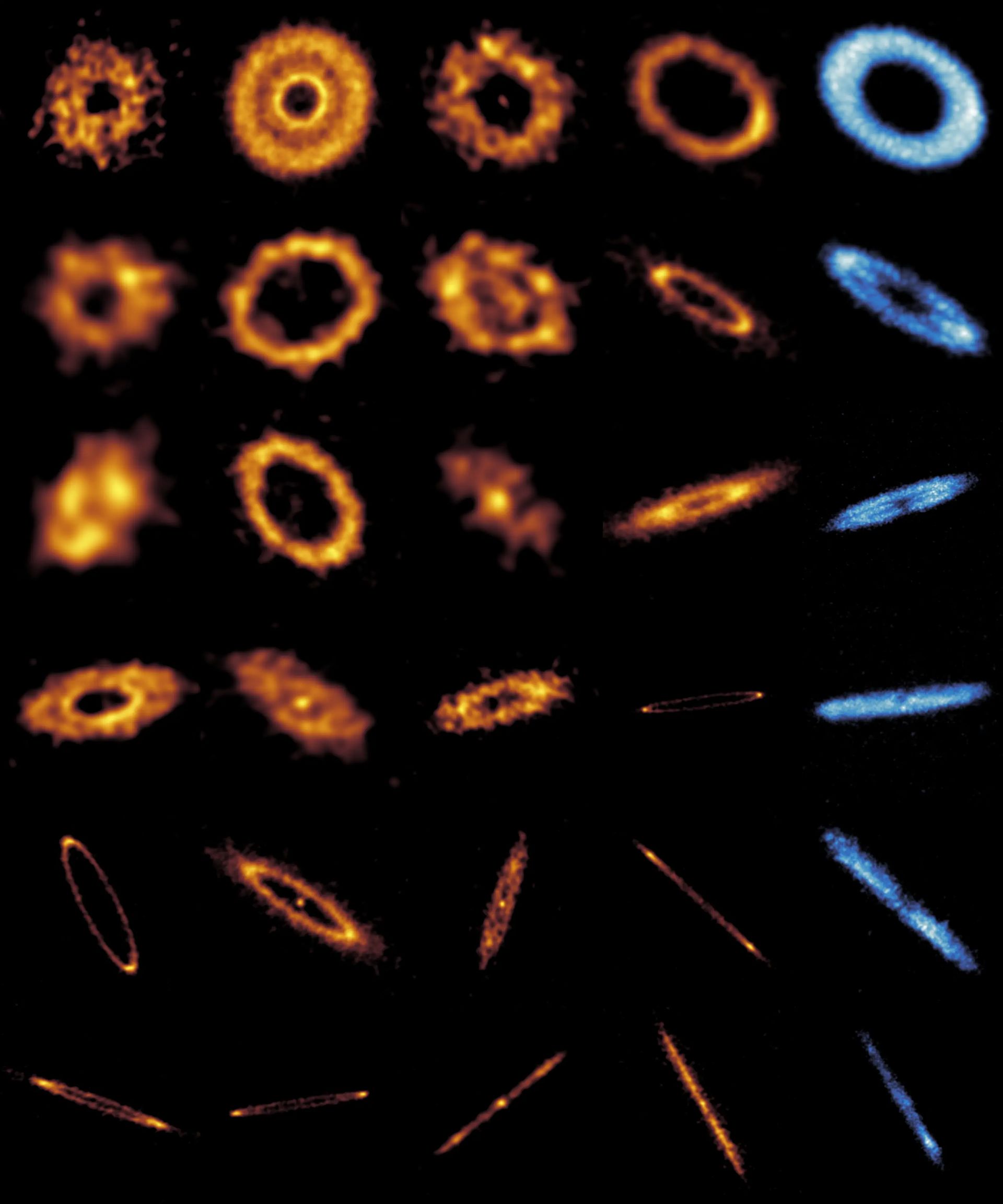

Debris Disks Left Behind After Planet Formation : ALMA

Astronomers using ALMA have produced the most detailed images to date of 24 debris disks, left after planets finish forming—the dusty, gas‑rich structures that represent the “teenage” phase of planetary systems. The ALMA survey to Resolve exoKuiper belt Substructures (ARKS) reveals disks with multiple rings, arcs, clumps, and wide halos, features that point to ongoing gravitational shaping by unseen planets. Several systems also show carbon‑monoxide gas with non‑Keplerian motion, indicating lingering dynamical activity long after planet formation should have settled. The amber colors highlight the location and abundance of the dust in the 24 discs surveyed, while the blue their carbon monoxide gas location and abundance in the six gas-rich discs.

The results provide a rare look at how young planetary systems evolve between early disk formation and long‑term stability, offering clues to processes that once shaped the outer regions of our own Solar System. (Credit: Sebastián Marino, Sorcha Mac Manamon, and the ARKS collaboration)

Pismis 24 Star Cluster : Chandra X-Ray Observatory, JWST

Astronomers combined data from Chandra and the James Webb Space Telescope to examine Pismis 24, a young star cluster embedded in the Lobster Nebula, about 5,500 light‑years away. Webb’s infrared view reveals dense, active regions of star formation, while Chandra’s X‑ray observations add bursts of red, green, and blue representing high‑energy emission from hot, newly formed stars.

Pismis 24 is one of the closest environments where astronomers can study the birth and early development of large stars, making it a key laboratory for understanding how such systems form and interact with their natal clouds. (Credit: X-ray: NASA/CXC/Penn State/G. Garmire; Infrared: NASA, ESA, CSA, and STScI; Image Processing: NASA/CXC/SAO/L. Frattare and NSA/ESA/CSA/STScI/A. Pagan)

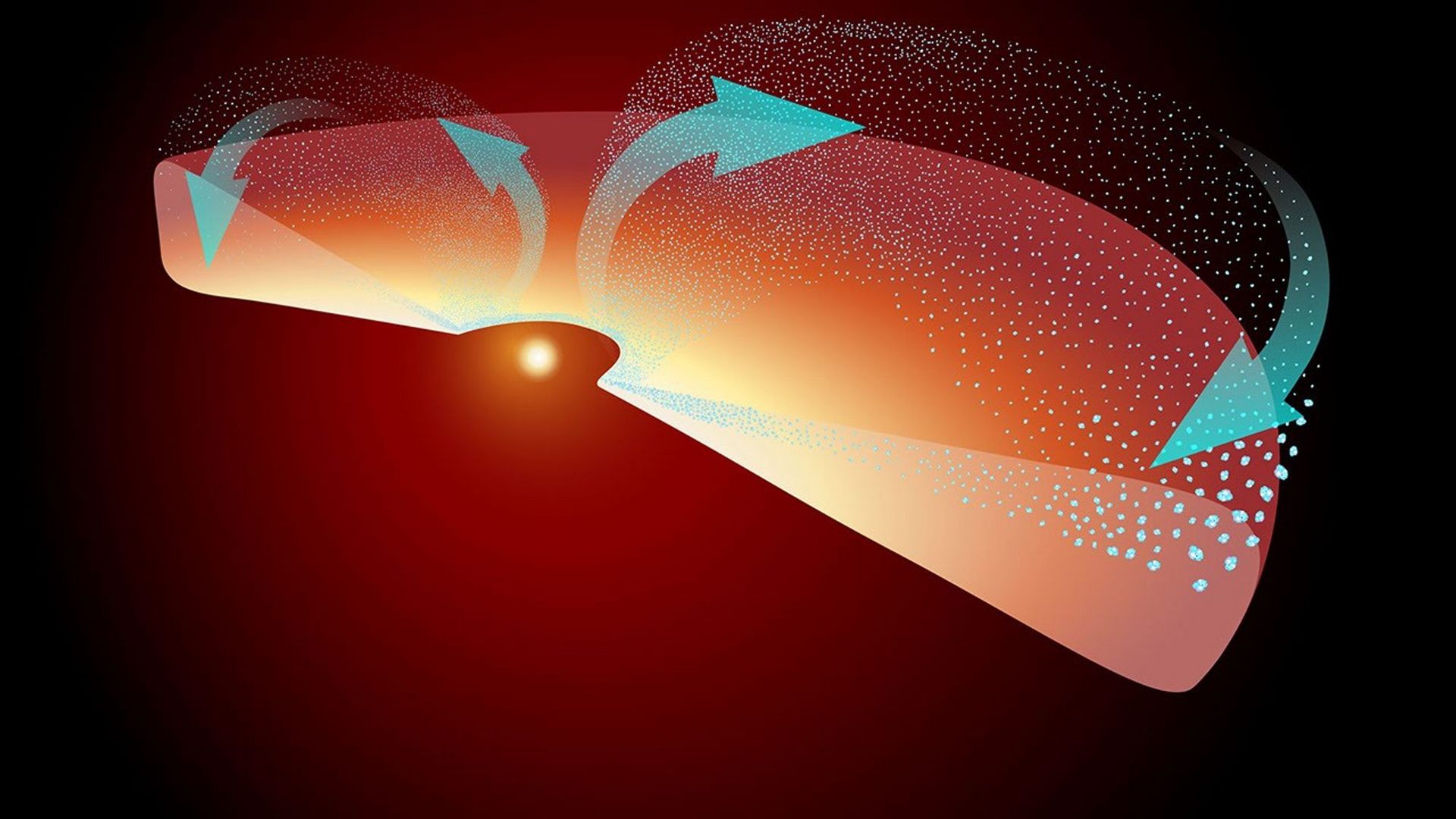

Protostar EC 53 in Serpens Nebula : James Webb Space Telescope

Astronomers using the James Webb Space Telescope have identified a young Sun‑like protostar, EC 53 (circled at left, 1,300 light-years away from Earth) in the Serpens Nebula, that is actively forging and ejecting common silicate crystals into its surrounding disk. Mid‑infrared data from Webb’s MIRI instrument reveal strong signatures of forsterite, a magnesium‑rich crystal typically found in comets and protoplanetary material. The observations show the crystals being transported outward by high‑velocity jets and winds, indicating that solid grains can form and disperse early in a star’s development. (Credit: NASA, ESA, CSA, STScI, Klaus Pontoppidan (NASA-JPL), Joel Green (STScI); Image Processing: Alyssa Pagan (STScI))

This illustration represents half the disk of gas and dust surrounding the protostar EC 53. Stellar outbursts periodically form crystalline silicates, which are launched up and out to the edges of the system, where comets and other icy rocky bodies may eventually form.

Astronomers have long puzzled over why comets in the outer solar system contain crystalline silicates, since such minerals require high temperatures to form while these icy bodies spend their lives in the frigid Kuiper Belt and Oort Cloud. Webb’s new observations now provide the clearest external evidence for how those conditions arise. The telescope shows that crystalline silicates are forged in the hot, inner regions of the disk surrounding a very young, actively forming star.

(Credit: NASA, ESA, CSA, Elizabeth Wheatley (STScI))

Lupus 3 Star-Forming Cloud : Hubble Space Telescope

Astronomers used the Hubble Space Telescope to examine Lupus 3, a nearby star‑forming cloud about 500 light‑years away in Scorpius, revealing a mix of bright newborn stars and dense pockets of gas and dust. The region contains several T Tauri stars (left, bottom right, and upper center), young Sun‑like objects, still contracting under the force of gravity to become main sequence stars.Their surrounding material is gradually dispersing through radiation, stellar winds, and episodic accretion, producing the irregular brightness changes that characterize this phase.

The image also highlights dark dust lanes and faint wisps of illuminated gas, showing how emerging stars reshape their environment. Because T Tauri stars represent a brief, early stage of stellar evolution—typically under 10 million years old—Lupus 3 offers a close look at the processes that govern how low‑mass stars form, shed their natal envelopes, and transition toward stable hydrogen fusion. (Credit: NASA, ESA, and K. Stapelfeldt (Jet Propulsion Laboratory); Processing: Gladys Kober (NASA/Catholic University of America))

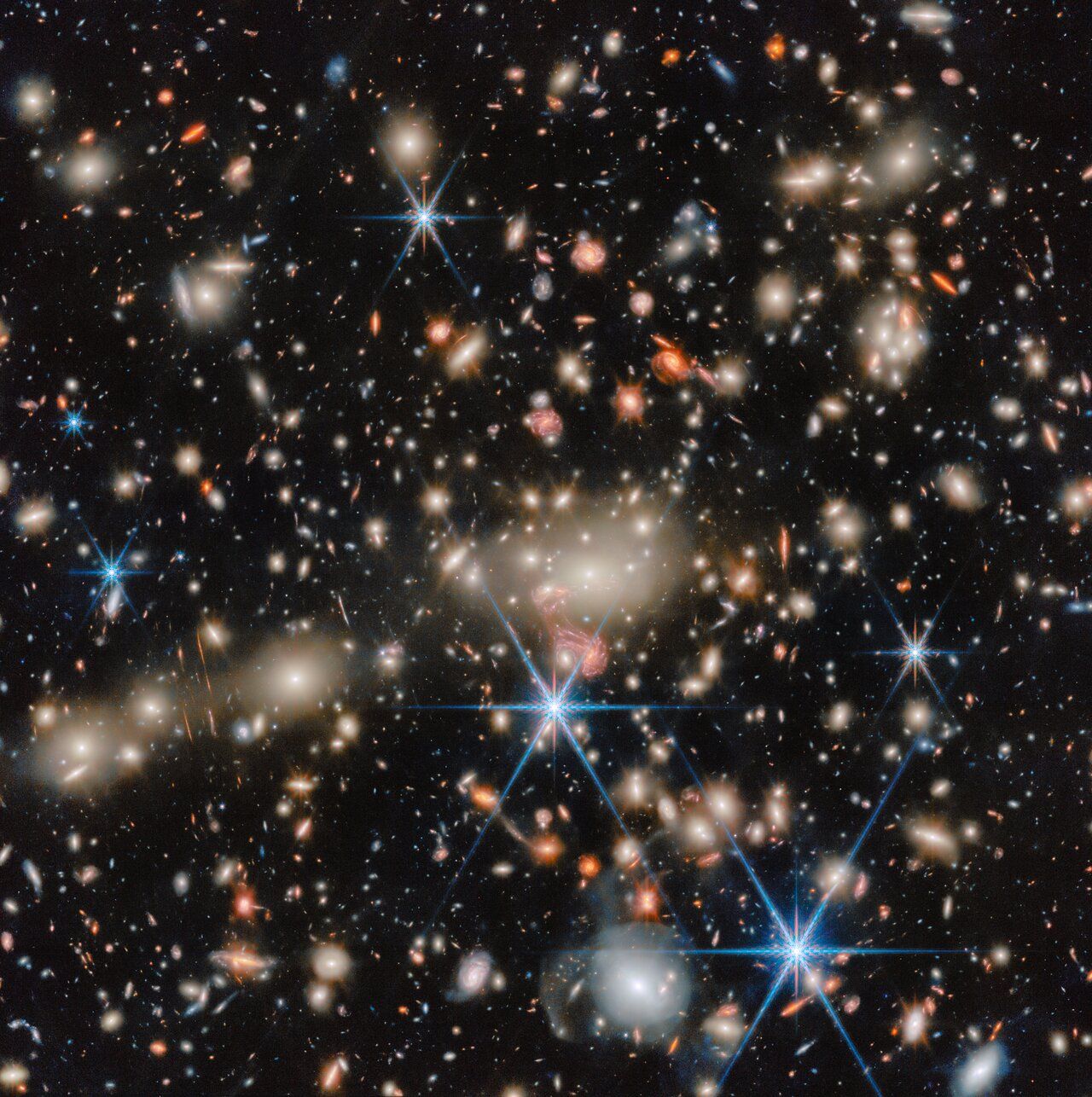

MACS J1149 Galaxy Cluster : James Webb Space Telescope

Astronomers used the James Webb Space Telescope to capture a detailed view of MACS J1149.5+2223, a massive galaxy cluster about 5 billion light‑years away whose gravity strongly distorts the light of more distant galaxies. More than 300 confirmed members form the cluster’s core, dominated by large elliptical galaxies whose combined mass bends spacetime and produces a wide range of gravitational‑lensing features.

Across the field, background galaxies appear stretched, magnified, or reshaped into arcs and streaks, including a notably distorted spiral whose lensed image resembles a pink, jellyfish‑like structure. MACS J1149 has been a key target for lensing studies, previously revealing a multiply imaged supernova and one of the most distant individual stars ever detected.

Webb’s new observations, collected through the CANUCS (CAnadian NIRISS Unbiased Cluster Survey) program, extend this work by probing faint, early galaxies and mapping the cluster’s mass distribution, offering fresh insight into galaxy evolution and the conditions of the reionization era. (Credit: ESA/Webb, NASA & CSA, C. Willott (National Research Council Canada), R. Tripodi (INAF - Astronomical Observatory of Rome))

SCIENCE

Lunar Lander May Contaminate Chemical Evidence Relevant to Earth’s Early Biology and Complicate Origins‑of‑Life Research on the Moon

A rendering of a lunar lander from the European Space Agency’s Argonaut program, slated for its first mission in 2030. Exhaust from spacecraft of this type could introduce methane into the Moon’s polar ice regions, potentially complicating studies of ancient chemical signatures linked to life’s origins. (Credit: ESA)

26 January, 2026

Lunar scientists from the Instituto Superior Técnico in Portugal, have warned that exhaust from upcoming lander missions could compromise some of the Moon’s most scientifically valuable regions. New modeling shows that methane released during descent can travel from pole to pole in under two lunar days, with roughly half settling in cold‑trap areas that may preserve chemical records relevant to the origins of life on Earth.

These permanently shadowed regions contain ancient volatiles that have remained largely undisturbed for billions of years. Researchers argue that even small amounts of modern contamination could make it difficult to distinguish primordial compounds from exhaust‑derived methane, complicating efforts to reconstruct early prebiotic chemistry. The concern is heightened by the rapid increase in planned lunar missions, many of which rely on propellants that generate methane during landing burns.

The findings, published in a paper in the Journal of Geophysical Research: Planets, add urgency to discussions about planetary‑protection standards for the Moon, which currently lack the stringent contamination controls applied to Mars. As more landers target polar regions for resource prospecting and science, researchers caution that without coordinated mitigation strategies, exploration activity itself may degrade the very environments needed to study Earth’s earliest chemical history.

Experiments Show Prebiotic Molecules Can Form in Interstellar Ice Before Planets Exist, Informing Origins‑of‑Life Research

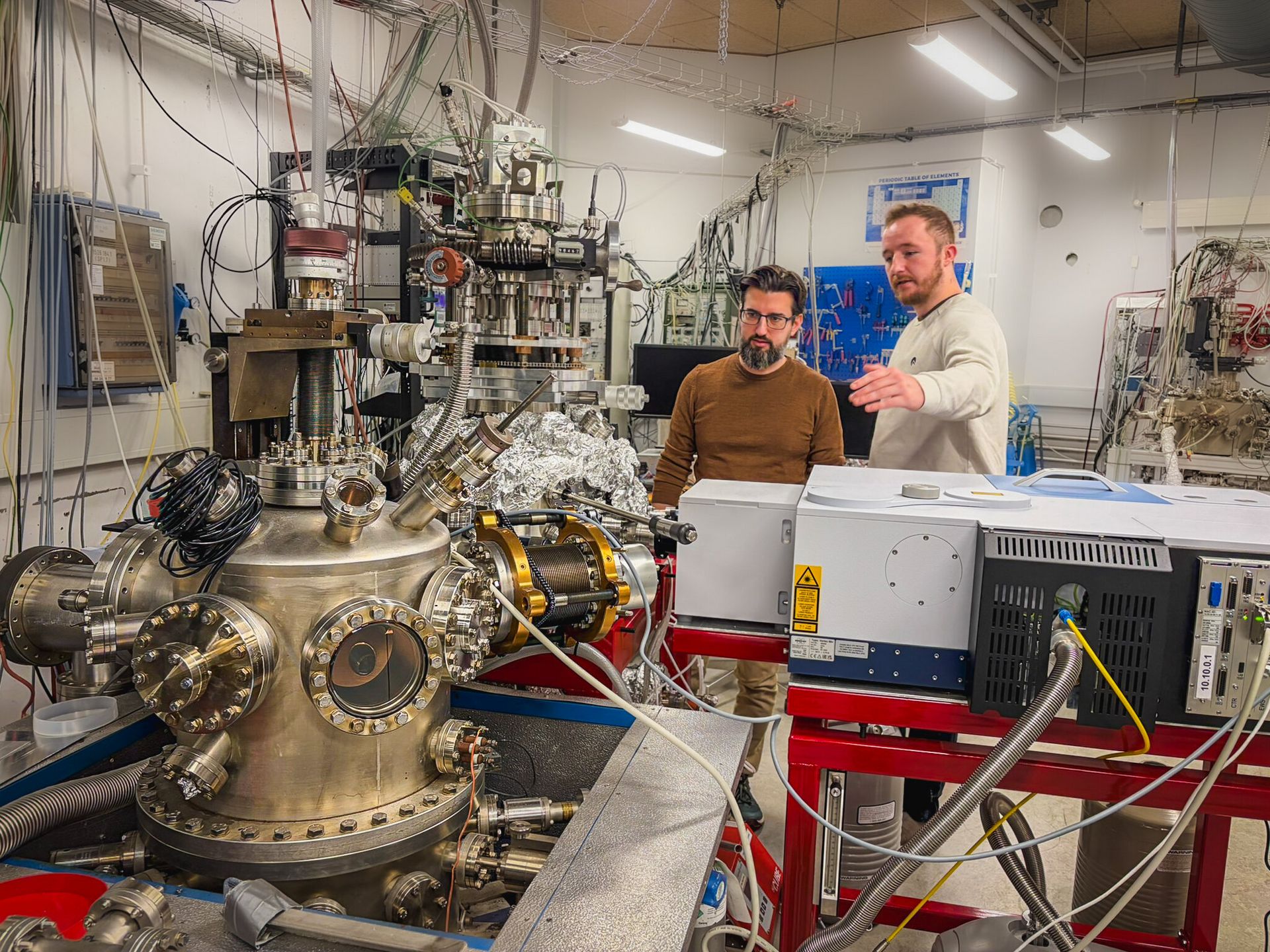

In the background, Associate Professor Sergio Ioppolo (left) and Postdoctoral Researcher Alfred Thomas Hopkinson (right) discuss upcoming experiments. In the foreground are two ultra‑high‑vacuum chambers used to study chemical reactions under interstellar‑medium conditions. (Credit: Dr. Signe Kyrkjebø, Aarhus University)

20 January, 2026

Laboratory experiments at Aarhus University, simulating interstellar ice suggest that complex prebiotic molecules can form spontaneously in space, offering a potential pathway for life’s chemical precursors to emerge before planets exist. Researchers recreated the extreme cold and radiation conditions found in molecular clouds, showing that simple compounds such as water, methanol and ammonia can reorganize into peptide‑like structures when exposed to ultraviolet light. These molecules, which resemble short protein fragments, formed without liquid water or planetary environments, supporting the idea that early biochemical building blocks may have been delivered to young worlds rather than synthesized exclusively on them.

The findings, published in the journal Nature Astronomy, add weight to models proposing that interstellar ices act as chemical reactors, producing increasingly complex organics as dust grains migrate through star‑forming regions. If such molecules were incorporated into comets or planetesimals, they could have seeded early Earth, and potentially other planets—with ingredients relevant to life’s emergence.

While the results do not demonstrate a full pathway to biology, they highlight how much prebiotic chemistry may occur in space itself, complicating efforts to pinpoint where life’s earliest steps truly began.

Europa’s Ice Shell Measured at ~30 Kilometers by NASA’s Juno, With Implications for Habitability

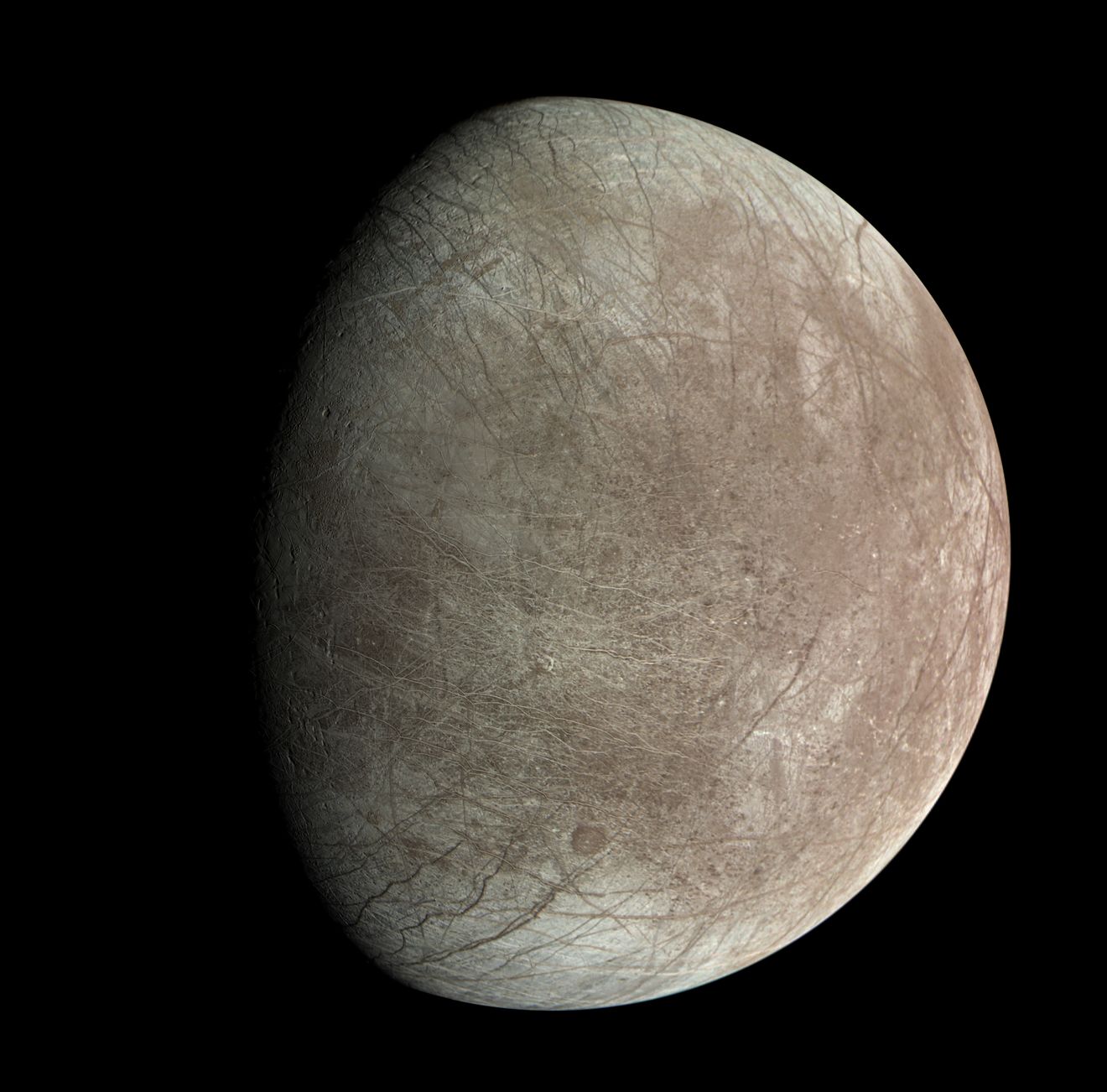

NASA’s JunoCam captured this view of Jupiter’s moon Europa during the spacecraft’s close flyby on Sept. 29, 2022, revealing the network of fractures, ridges and bands that mark its surface. (Credit: NASA/JPL‑Caltech/SwRI/MSSS; image processing by Björn Jónsson)

27 January, 2026

NASA’s Juno mission has produced the clearest constraints yet on the thickness of Europa’s ice shell, using gravity and topography data gathered during a close 2022 flyby. The analysis indicates an average thickness of roughly 30 kilometers, with local variations that may reach deeper in some regions. The findings, published in the journal Nature Astronomy, refine long‑standing estimates that ranged widely and were difficult to validate without direct measurements.

Scientists note that a thicker shell complicates prospects for near‑term access to Europa’s subsurface ocean, a key target for assessing habitability. While the moon still hosts a global ocean with the necessary energy sources for chemical activity, a more substantial ice barrier could limit exchange between the surface and interior, reducing the likelihood that ocean‑derived materials reach the surface where spacecraft can sample them.

The results also underscore the challenges facing future missions such as Europa Clipper, which will rely on remote sensing to infer ocean properties rather than penetrating the ice. Researchers emphasize that even with a thicker shell, Europa remains one of the Solar System’s most compelling astrobiological targets, but the new measurements highlight the technical and scientific constraints shaping upcoming exploration strategies.

NOAA’s Space Weather Observatory Arrives on Lagrange Point 1

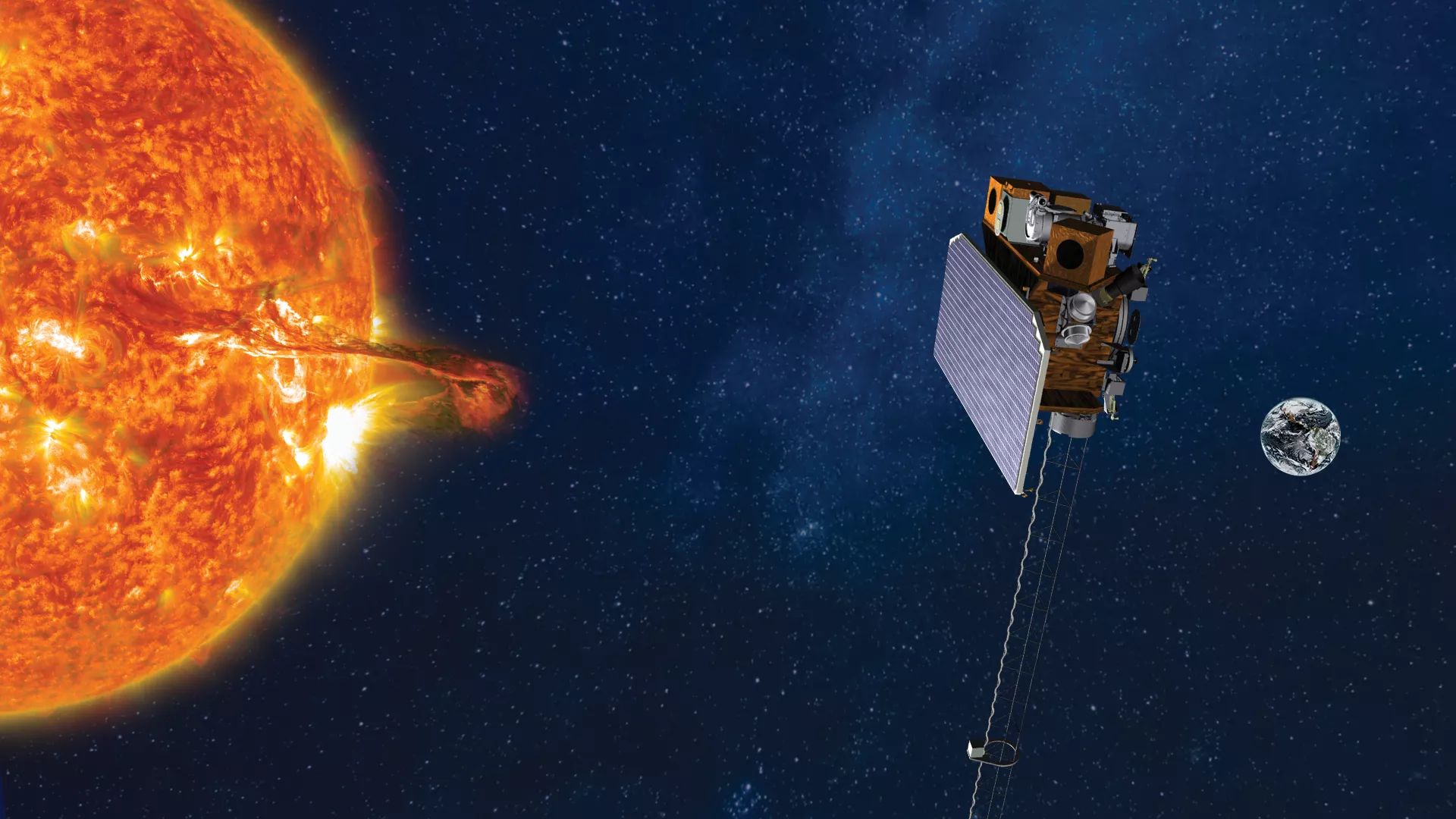

A rendering of SWFO-L1 spacecraft. (Credit: NOAA/BAE Space & Mission Systems)

27 January, 2026

NOAA’s space‑weather architecture is entering a transition period as the agency balances new operational assets with budget pressure across multiple programs. The Space Weather Follow On–L1 (SWFO-L1), now renamed Space weather Observations at L1 to Advance Readiness – 1 or SOLAR-1 mission, has now reached the Lagrange Point 1 orbit, 1.6 million kilometers / 1 million miles away from Earth where it will take over solar‑wind and coronal‑mass‑ejection monitoring from aging DSCOVR and ACE space weather stations. The handover is expected later this year, but NOAA officials note that sustaining continuous coverage will require additional investments as legacy systems approach end of life.

China’s Space Epoch Targets 2028 for First Crewed Suborbital Flight for Tourism While Long March Mission Deploys Algeria’s Alsat‑3B Satellite

29 January, 2026

China’s commercial human‑spaceflight sector is beginning to take clearer shape as Space Epoch outlines plans for its first crewed suborbital mission in 2028, positioning itself as one of the country’s earliest entrants into the space‑tourism market. The company says it will conduct a series of uncrewed verification flights in 2026 and 2027 before flying passengers, and has already signed a well‑known Chinese entertainer for a future mission to boost public visibility. Its vehicle, designed for vertical takeoff and landing, is intended to carry up to seven people on brief suborbital trajectories.

The announcement comes as China encourages private participation in human‑spaceflight‑related technologies under its broader commercial‑space policy framework. Space Epoch’s leadership argues that domestic demand for high‑profile tourism experiences will grow as safety records improve and costs decline, though the company has not disclosed pricing or regulatory milestones. The firm is also developing training programs and partnerships to prepare future passengers.

While the initiative reflects rising confidence among Chinese commercial launch and spaceflight companies, it also highlights unresolved issues around certification, liability and integration with state‑run human‑spaceflight systems. As more private firms pursue crew‑capable vehicles, China will need to clarify oversight mechanisms to ensure that commercial ambitions align with national safety and operational requirements.

Algeria launched its Alsat‑3B remote‑sensing satellite on January 31, 2026, using a Long March 2C rocket from China’s Jiuquan Satellite Launch Center. (Credit: Africa News Agency)

Meanwhile, China’s broader launch cadence is being reshaped by preparations for a key human‑spaceflight test. The launch of Algeria’s Alsat‑3B remote‑sensing satellite on a Long March 2D proceeded as planned, following the January 14 launch of AlSat-3A, but additional missions have been delayed as resources shift toward the upcoming crew‑vehicle milestone. Both spacecraft were built by the China Academy of Space Technology (CAST), a key subsidiary within the China Aerospace Science and Technology Corporation (CASC).

Scientists Reevaluate Habitable‑Zone Limits as New Research Expands the Search for Alien Life

Traditional picture of the habitable zone – not too hot, not too cold. (Credit: NASA)

29 January, 2026

Scientists are reassessing long‑held assumptions about where life might exist beyond Earth, arguing that the traditional habitable‑zone model—which focuses on planets with surface liquid water—may be too narrow. Because the water in this region is at temperatures suitable for remaining liquid, the habitable zone is often referred to as the “Goldilocks zone.” However, new research highlights that many potentially life‑supporting environments lie outside these zones, including subsurface oceans on icy moons, planets with thick insulating atmospheres, and worlds heated by tidal forces rather than sunlight. These environments could sustain stable liquid water even when a planet or moon receives little stellar energy.

There is growing evidence from the Solar System that bodies such as Europa, Enceladus, and Titan host internal oceans despite being far from the Sun’s classical habitable region. Researchers note, in a paper published in the Astrophysical Journal, that exoplanet surveys may be overlooking similar worlds, especially those whose life‑supporting conditions are hidden beneath ice or dense atmospheres.

The emerging view suggests that habitability is more strongly tied to energy sources, chemistry, and environmental stability than to orbital position alone. As detection methods improve, scientists argue that expanding search criteria beyond the Goldilocks zone will be essential for identifying a broader—and potentially more realistic—range of life‑bearing worlds.

GOVERNANCE

European Union Deploys GOVSATCOM Secure Satcom Network Using Pooled National Capacity Across Member States

Credit: EUSPA/EU/ESA

27 January, 2026

The European Union has activated GOVSATCOM, its new secure satellite‑communications service for governmental and security‑critical users, marking a step toward consolidating fragmented national capabilities into a shared, EU‑level system. The initial service, brought online on 14 January, pools capacity from eight satellites across five member states, providing encrypted links for crisis response, border management, maritime surveillance, and other civilian‑military missions.

Announced in 2018, the Governmental Satellite Communications initiative (GOVSATCOM) is designed to offer resilient, cost‑controlled access to satcom services for EU institutions and member states, addressing long‑standing concerns about dependence on commercial or non‑European providers. The program forms part of the EU’s broader space‑security agenda, alongside initiatives supporting maritime strategy, Arctic policy, and external‑action missions.

Officials frame the service as a sovereignty measure, but its reliance on pooled national assets highlights the incremental nature of Europe’s approach. The system remains a precursor to more ambitious architectures envisioned under IRIS², the multi-orbital constellation of 290 satellites, now expected in 2029, instead of 2030, and its effectiveness will depend on how consistently member states commit capacity and funding.

Retired Russian Inspector Satellite Breaks Apart in Graveyard Orbit, Raising GEO Debris Concerns

Optical tracking by s2A Systems captured the fragmentation of Russia’s Luch/Olymp inspector satellite in graveyard orbit on Jan. 30, 2026, showing multiple debris pieces dispersing from the spacecraft. (Credit: s2A Systems)

30 January, 2026

A Russian Luch/Olymp “inspector” satellite has fragmented in its graveyard orbit above geostationary altitude, raising new concerns about debris hazards in regions long assumed to be relatively stable. Ground‑based optical observations from Swiss firm s2A Systems detected the breakup on January 30, 2026, capturing a clear fragmentation event at 06:09 UTC.

The spacecraft, launched in 2014 and previously used to maneuver near and observe other satellites in GEO, had been retired and moved a few hundred miles above the belt in late 2025. Analysts, including Jonathan McDowell, suggest the breakup was likely caused by an external debris impact rather than internal failure or improper passivation—an assessment that points to a more hazardous debris environment in both GEO and its disposal orbits than previously understood.

The event adds to growing evidence that high‑altitude orbits are accumulating untracked fragments capable of damaging operational spacecraft. With GEO hosting critical communications, weather and military assets, the incident underscores the limitations of current monitoring capabilities and the need for more comprehensive debris‑mitigation strategies as aging satellites continue to populate disposal orbits.

MILITARY

South Korean Hanwha Expands Global Defense and Space Footprint Through K‑LEO Constellation Work With Canadian MDA, Telesat and Norway’s Chunmoo Acquisition

26 January, 2026

Hanwha, the South Korean conglomerate with a portfolio that includes aerospace, defense, solar energy, is broadening its defense and industrial footprint through a set of parallel international initiatives that link space‑based capabilities, weapons exports, and cross‑sector industrial partnerships. The company is exploring collaboration with Canada’s MDA Space and Telesat on South Korea’s planned K‑LEO sovereign defense constellation, a program intended to provide secure national‑security communications.

The partners are assessing whether MDA’s software‑defined Aurora platform, already central to Telesat’s Lightspeed LEO network, could serve as the backbone for South Korea’s K‑LEO defense constellation, including potential development of interoperable user terminals for both systems. The company is also evaluating how Lightspeed connectivity could be integrated into a range of South Korean defense and weapons systems as part of broader potential cooperation in international defense markets.

These space agreements sit alongside a wider campaign to deepen ties with Canada. Hanwha has signed multiple MOUs with Canadian firms, including Algoma Steel, Telesat, MDA Space, Cohere, and PV Labs, as part of its bid for the Canadian Patrol Submarine Project (CPSP), positioning the submarine program within a larger industrial cooperation framework spanning steelmaking, AI, satellite communications, and defense electronics.

Chunmoo launcher. (Credit: Hanwha Aerospace)

2 February, 2026

At the same time, Hanwha Aerospace has secured an export win in Europe, signing a $922 million contract to supply 16 Chunmoo multiple‑rocket launcher systems (MRLS), precision-guided munitions and Integrated Logistics Support (ILS) to Norway, as part of Oslo’s long‑range fires modernization effort. Hanwha Aerospace signed the contract with the Norwegian Defence Materiel Agency (NDMA), beating U.S. and European competitors such as Lockheed Martin for the country’s next-generation rocket artillery system. The overall acquisition program is valued at 19 billion Norwegian kroner ($2 billion)

Norwegian officials said the Chunmoo system met all required performance criteria, including strike ranges reaching 500 kilometers, and offered the shortest delivery timeline among the competing bids.Deliveries are scheduled from 2028 through 2031, and the deal reinforces Hanwha’s strategy to expand its role as a long‑term security partner in the Nordic region.

US Space Force Accelerates Shift to Commercial‑First Proliferated GEO Surveillance Through RG‑XX Program as Latest GPS III‑9 Reaches Orbit

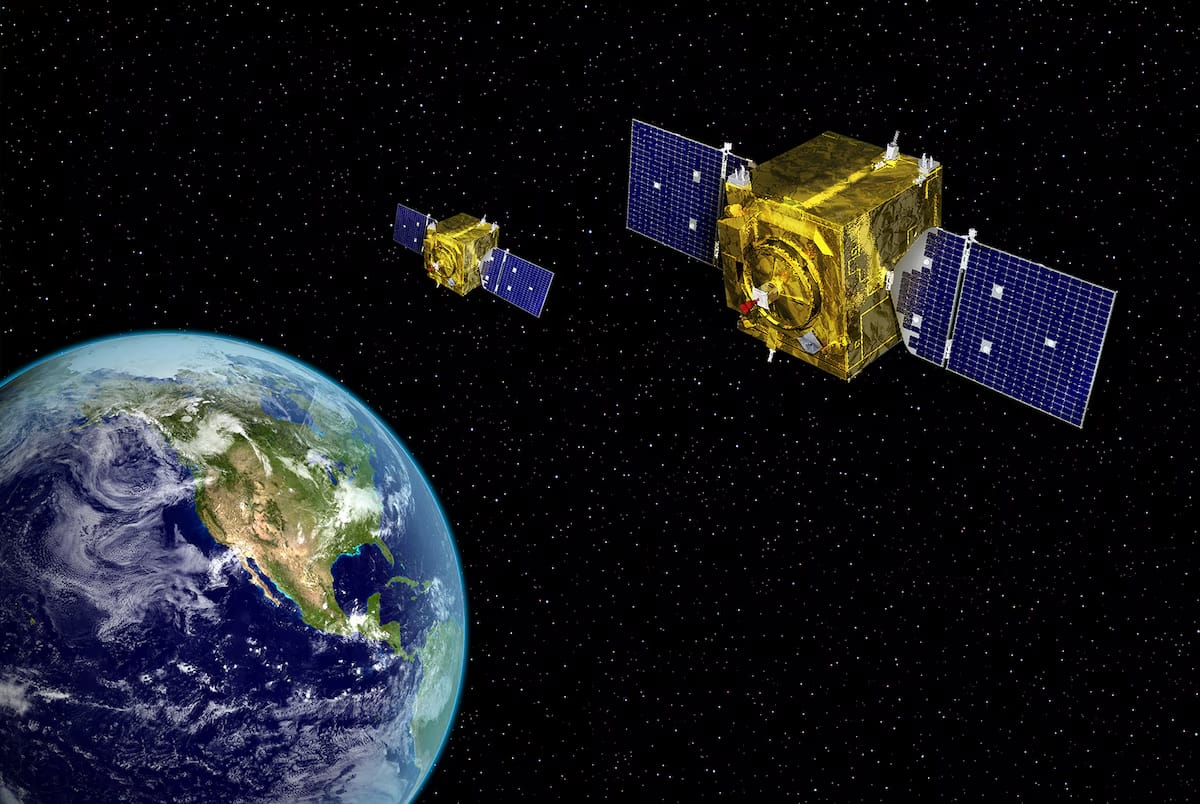

An artist’s rendering of GSSAP. (Credit: US Space Force)

27 January, 2026

The U.S. Space Force is moving toward contractor selections for its Geosynchronous Reconnaissance & Surveillance (RG‑XX) program, a next‑generation GEO surveillance effort that shifts from bespoke “exquisite” satellites to commercially derived designs. Officials expect to choose multiple vendors by March, using an IDIQ contracting model to issue recurring task orders and accelerate procurement. The constellation is intended to be significantly larger than the current Geosynchronous Space Situational Awareness Program (GSSAP) fleet (built by Northrop Grumman), which performs high‑demand space‑domain‑awareness missions in GEO.

Program leaders describe RG‑XX as a test case for a “commercial‑first” acquisition strategy, meant to address both evolving threats in GEO and the maturation of industry capabilities. The Space Force is also preparing to launch the 7th and 8th GSSAP satellites in mid‑February, with two more in production, even as RG‑XX is positioned to assume much of that mission over time, though not as a one‑for‑one replacement.

A key architectural shift is the decision to design RG‑XX satellites for on‑orbit refueling, enabling extended operational life, something GSSAP spacecraft cannot support. Officials say the service is laying groundwork for future refueling services but has not yet defined a long‑term plan. The ground segment remains under development, with the goal of a common system compatible across multiple manufacturers.

Separately, the Space Force successfully launched the GPS III‑9 (SV09) satellite aboard a SpaceX Falcon 9 on January 27, adding another jam‑resistant, M‑Code‑enabled spacecraft to the military’s navigation constellation. The Lockheed Martin–built satellite achieved signal acquisition shortly after deployment.

Northwood Space Raises $100 Million and Secures Space Force Contract to Expand Automated Ground‑Station Network

Portal phased‑array antennas are built in‑house at Northwood Space. (Credit: Northwood Space, via SpaceNews)

27 January, 2026

Northwood Space, a startup that focuses on mass producing ground stations, has raised $100 million in Series B funding and secured a $50 million U.S. Space Force contract, positioning the company to scale its automated ground‑station network and expand into government missions. The funding round, led by existing and new investors, supports the build‑out of Northwood’s modular “Space Ground System,” which expects to reduce the cost and complexity of satellite command and control by standardizing hardware and automating operations.

The Space Force contract tasks Northwood with developing a next‑generation satellite control network that can integrate commercial ground infrastructure into military architectures. Officials have framed the effort as part of a wider agenda to diversify ground‑segment providers and increase resilience through distributed, commercially derived systems.

Northwood says its approach—treating ground stations as scalable, software‑defined infrastructure—enables faster deployment and more flexible support for proliferated constellations. The company says it has already deployed its multi-beam phased array system called Portal units on two continents, including one site installed within 12 hours and operational the following day. The new funding will accelerate production and global rollout, with plans to manufacture more than a dozen arrays per month and field over 80 beams across 18 sites by year’s end.

U.S. Space Command Brings Commercial Firms Into Classified Nuclear‑Threat Wargames

29 January, 2026

U.S. Space Command will now bring commercial space companies into classified nuclear‑threat wargames for the first time. Evidencing the degree to which national security operations now depend on privately owned space infrastructure, the commander of the United States Space Command, Gen. Stephen Whiting said the initial tabletop exercise, beginning in March, will examine U.S. responses to the potential deployment of a weapon of mass destruction in orbit, a scenario driven by U.S. warnings that Russia may be developing a space‑based nuclear anti‑satellite device.

Officials emphasized that a nuclear detonation in space, though prohibited under the 1967 Outer Space Treaty, would produce widespread radiation and electromagnetic effects capable of disabling satellites across multiple orbits, with long‑lasting consequences for civilian, commercial and military systems. While no such weapon is believed to be operational, the prospect is viewed as destabilizing and strategically significant.

Space Command already relies heavily on commercial operators for tracking, communications and mission support. Integrating those firms directly into classified planning is intended to improve coordination and ensure continuity of critical services in extreme scenarios. The exercises will be held quarterly with a select group of industry partners.

While Space Command argues that commercial participation is necessary given the private sector’s growing role in national space infrastructure, the move also raises questions about how deeply industry should be embedded in classified national‑security planning. Commercial firms now sit at the center of U.S. military space operations, but their direct inclusion in nuclear‑threat scenarios highlights an expanding reliance that can be viewed as strategically risky—blurring the line between civilian operators and military decision‑making in crises.

COMMERCIAL

Countries Expand Space Capabilities Through New Satellite Procurements and Launches

Astranis–MB Group, Avio’s Vega‑C Missions, Airbus’ Pléiades Neo Next, Satellogic–HEO, and Rocket Lab–KAIST

This week saw a noticeable uptick in satellite procurements and launches, with several countries adding new capacity across communications and Earth‑observation.

Credit: Astranis

26 January, 2026

Oman’s oil and gas conglomerate, MB Group, has ordered a small geostationary broadband satellite from the U.S.-based Astranis. This secures the Sultanate’s first dedicated MicroGEO communications satellite as part of MB Group’s broader $200 million investment aligned with Oman Vision 2040 to strengthen national digital autonomy. The spacecraft, contracted under Astranis’ Block 3 launch, is scheduled to fly later this year on a SpaceX Falcon 9, with services expected to begin by early 2027. The program includes new ground stations and supporting infrastructure, positioning Oman as an anchor customer for dedicated, rather than shared, regional capacity, marking a significant expansion of sovereign satellite infrastructure across the Middle East.

27 January, 2026

A Vega‑C rocket lifts off from Europe’s Spaceport in French Guiana carrying South Korea’s KOMPSAT‑7 Earth‑observation satellite, in December 2025. (Credit: ESA-CNES-Arianespace/Optique Vidéo du CSG - S. Martin)

In parallel, Brazil has confirmed that its Amazonia‑1B Earth‑observation satellite will launch aboard an Avio‑built Vega‑C rocket in 2027, following a contract between the country’s National Institute for Space Research (INPE) and U.S.-based launch aggregator SpaceLaunch. Avio had previously announced a launch services agreement for an unnamed extra‑European institutional customer, later revealed to be Brazil. The satellite will extend Brazil’s long‑term monitoring of the Amazon rainforest and agricultural regions, building on the earlier Amazonia‑1 mission.

27 January, 2026

Europe’s launch sector also advanced with Airbus selecting Vega‑C to launch the first satellite in its Pléiades Neo Next constellation, planned for early 2028. The next‑generation system will deliver 20‑cm‑class native resolution, improving revisit rates and expanding commercial and governmental imaging capabilities. The program builds on the existing Pléiades Neo fleet and reflects Airbus’ strategy to maintain leadership in high‑resolution Earth‑observation services.

27 January, 2026

Meanwhile, Australia has taken a major step toward sovereign space capability. Through a new agreement with U.S.-Uruguay-based Earth-observation company Satellogic, the Australian Non-Earth imaging company HEO has acquired full ownership of Satellogic’s in‑orbit NewSat‑34 satellite (a legacy Mark IV-g satellite), renamed Continuum‑1, becoming the first Australian entity to operate a sub‑meter‑resolution spacecraft. The satellite provides immediate operational capacity and serves as a dedicated testbed for non‑Earth imaging research, marking a shift in how nations can rapidly obtain independent orbital assets without lengthy build‑and‑launch cycles.

The Electron’s first stage descends toward Earth after launching South Korea’s NEONSAT‑1A from New Zealand on Jan. 29, 2026. (Credit: Rocket Lab)

28 January, 2026

Launch activity also continued in the Asia‑Pacific region. Rocket Lab successfully deployed South Korea’s NEONSAT‑1A aboard an Electron rocket after earlier delays. The satellite, developed by the Satellite Technology Research Center (SaTReC) at the Korea Advanced Institute of Science and Technology (KAIST), will support near‑real‑time disaster monitoring across the Korean Peninsula and forms part of a planned constellation aimed at improving national resilience and situational awareness. The "Bridging the Swarm" mission, Rocket Lab’s second launch in eight days, placed the spacecraft into a 540‑km low‑Earth orbit.

These developments illustrate efforts towards sovereign control, regional specialization, and rapid deployment across the global space sector. Nations are increasingly investing in dedicated assets, whether for communications, environmental monitoring, or high‑resolution imaging, while commercial launch providers and satellite manufacturers compete to supply tailored, rapidly deliverable systems. The result is a more distributed, capability‑driven orbital landscape, where states and companies alike seek autonomy, resilience, and strategic advantage through space‑based infrastructure.

NASA Evaluation Shows PlanetiQ Radio‑Occultation Data Performs Well for Weather and Climate Use

27 January, 2026

NASA’s year‑long evaluation of PlanetiQ’s GNSS‑RO measurements has found the company’s products to be high quality and broadly comparable to benchmark missions, including COSMIC‑2 (a U.S.–Taiwan constellation of six satellites launched in 2019 that provides some of the world’s highest‑quality GNSS‑RO data) and other commercial constellations, with particularly strong performance in total electron content precision and signal‑to‑noise ratio.

GNSS‑RO measurements are radio‑occultation observations made using signals from global navigation satellites (like GPS, Galileo, GLONASS). As those signals pass through Earth’s atmosphere, they bend, and that bending reveals temperature, pressure, and moisture profiles with high vertical resolution

NASA’s Commercial Satellite Data Acquisition (CSDA) program, which purchases commercial datasets to supplement Earth‑science observations, highlighted PlanetiQ’s ability to deliver deep atmospheric penetration into the lower troposphere, a region critical for boundary‑layer studies and weather forecasting. The company’s Pyxis sensor, capable of receiving signals from all major GNSS constellations, was noted for providing vertically resolved profiles that can support both meteorology and space‑weather applications.

The findings position PlanetiQ as a potential contributor to future operational data streams as agencies consider expanding commercial data use for climate and forecasting models. The evaluation has not yet been released.

Study Finds U.S. and Europe Use “Commercial” Space Procurement in Divergent and Often Confusing Ways

Credit: The Aerospace Corporation

28 January, 2026

Governments in the United States and Europe increasingly describe their space programs as “commercial,” but a new joint study by the European Space Policy Institute (ESPI) and The Aerospace Corporation argues the term has stretched so widely that it obscures what states are actually procuring. The report warns that this ambiguity can produce mismatched expectations: policymakers sometimes anticipate market‑driven behavior from programs still structured like traditional government developments, while companies are occasionally asked to absorb commercial risk without access to a broader customer base that would make that risk sustainable, limiting both efficiency and industry growth.

The report finds that both regions are expanding their use of private providers, yet they do so through distinct procurement cultures: U.S. agencies lean on fixed‑price contracts and competition to shift cost and technical risk to industry, while European programs often retain strong public oversight driven by industrial policy and strategic autonomy.

To bring clarity, the authors outline three procurement models. Programs in the “Commercial‑Lite” category still place most financial and technical responsibility on the government, even if industry plays a more visible role than in traditional bespoke developments. “Commercial‑Led” initiatives hand companies greater control over design and development, but public agencies continue to cushion the risk through tools like milestone payments, access to state infrastructure, or commitments to future demand. “Purely commercial” arrangements, still uncommon in the space domain, are those in which governments simply purchase an existing service that firms already provide to multiple customers.

The study highlights how these categories manifest differently across regions. In Europe, programs such as IRIS², Copernicus data purchases, and military satellite communications often retain strong public oversight even when labeled commercial. In the United States, NASA’s commercial crew program, NOAA’s commercial data buys, and Pentagon constellation procurements use fixed‑price contracts and competitive awards more aggressively to shift risk onto industry. The authors ultimately argue that without clearer definitions and better alignment between policy goals and contract structures, governments risk misjudging outcomes and overstating how market‑driven their space programs truly are.

Astroscale and Exotrail Partner to Develop Dedicated European LEO Deorbiting Services by 2030

Astroscale’s patented docking mechanism is designed to capture and stabilize tumbling satellites, a capability that underpins future European deorbiting and servicing missions. (Credit: Astroscale)

28 January, 2026

In a bid to address the growing pressure on operators to manage end‑of‑life disposal as orbital congestion increases, Astroscale France and French end-to-end space mobility operator, Exotrail have formed a strategic partnership to develop dedicated deorbiting services for satellites in low Earth orbit. The collaboration brings together Astroscale’s in‑orbit servicing experience and Exotrail’s mobility systems, including its spacevan transfer vehicle, with the goal of conducting a first in‑orbit demonstration before 2030.

The companies frame the effort as a step toward a more structured European approach to debris mitigation, positioning deorbiting as critical infrastructure rather than an optional service. Their roadmap targets constellation‑class satellites, which represent the bulk of projected future traffic and pose the greatest long‑term sustainability challenges.

The partnership is also in line with an industry-wide trend to choose collaboration over complete in‑house development, as firms seek faster paths to operational capability in a tightening regulatory environment. By combining propulsion, servicing, and mission‑design expertise, the two companies aim to offer operators a controlled, verifiable disposal option aligned with emerging European policy priorities

New Space‑Focused SPAC Debuts on Nasdaq With $200 Million to Pursue Sector Merger Opportunities

29 January, 2026

A new space‑focused special purpose acquisition company (SPAC), Space Asset Acquisition Corp., began trading on Nasdaq on January 28 after raising $200 million to pursue a merger with a space‑sector firm, SpaceNews has reported. The SPAC, chaired by venture capitalist Raphael Roettgen, priced its units at $10, each comprising a share and a third of a warrant exercisable at $11.50. Warrant pieces function like an option, so once an investor holds three of them, they can combine them to buy an additional share in the future at a fixed price of $11.50, regardless of where the stock is trading at that time.

While the vehicle is technically sector‑agnostic, its stated intent is to target companies operating across the global space economy, including technology and defense. The sponsor group includes members of the management team and financial services firm BTIG, which underwrote the offering. Roettgen is the founding partner of Earth-to-Mars Capital (E2MC), a U.S.-based investment firm whose portfolio spans more than 30 space companies across eight countries, including major players such as SpaceX and emerging ventures like in‑space manufacturing startup Space Forge.

The leadership, also drawn from Cambium Capital, and Tremson Capital, has prior experience with blank‑check companies, including efforts that were completed, withdrawn, or still pending. The launch comes amid tentative signs of renewed SPAC activity in the space sector following a period of cooling, highlighted by iRocket’s planned merger with BPGC Acquisition Corp. Shares closed up 2.2% on the first day

Eutelsat Ends Planned Sale of Ground Infrastructure to EQT After Failing to Secure French Approval

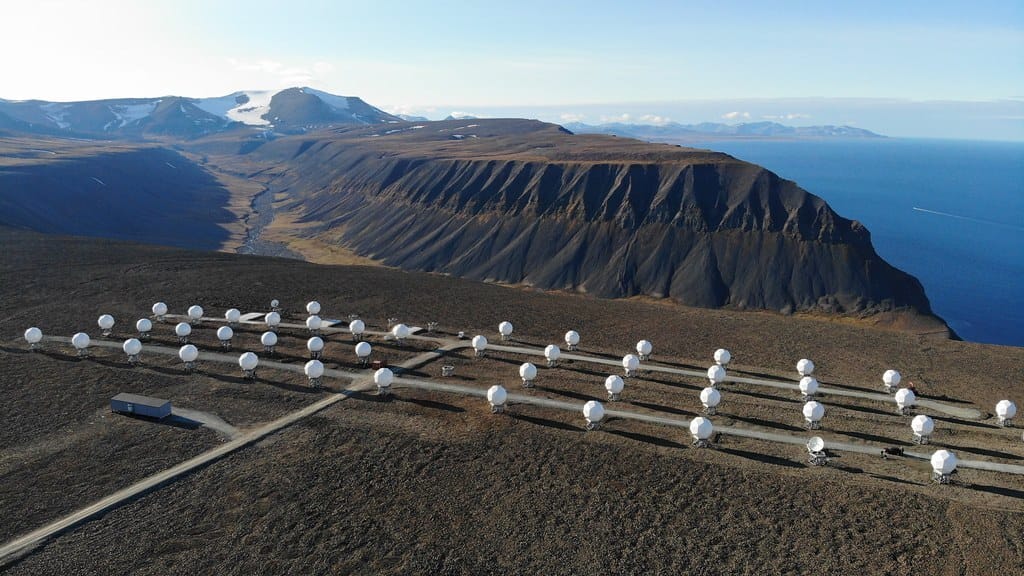

Eutelsat’s SNP site in Svalbard. (Credit Eutelsat / OneWeb)

30 January, 2026

Eutelsat has cancelled its planned sale of passive ground‑segment assets to Swedish private equity firm, EQT Infrastructure, after the deal failed to secure required approvals, including clearance from French authorities concerned about national security and the strategic value of the infrastructure. The transaction, announced in 2024 and expected to generate about €550 million, would have transferred Eutelsat’s land, buildings, antennas and other passive ground assets into a new entity intended to become the world’s largest pure‑play, operator‑neutral ground‑station‑as‑a‑service provider, SatPort Infrastructure. EQT created SatPort to acquire a majority stake, with Eutelsat set to retain a minority position.

Eutelsat had previously warned that selling the ground assets would reduce its annual EBITDA by €75–80 million because it would no longer operate those assets. Since the sale is no longer happening, that negative impact goes away, Eutelsat keeps the assets and keeps the associated earnings. However, because the company will no longer receive the cash from the sale, its net‑debt‑to‑EBITDA ratio will be higher than planned, now about 2.7 times instead of 2.5 times by June 2026.

French officials publicly confirmed they blocked the sale, citing the importance of ground stations for sovereignty and for maintaining a European competitor to Starlink. The government’s move followed a political backlash in France over its earlier decision to allow the sale of LMB Aerospace, a domestic producer of specialised ventilators used in defence platforms such as the Rafale fighter jet, to U.S. group Loar. Opposition parties, including the far right, seized on that transaction as evidence that France was relinquishing sensitive industrial capabilities. The economy ministry has since noted that the state retained a preference share in LMB.

Eutelsat said the outcome does not alter its broader growth plans, including replenishing the OneWeb LEO constellation following last year’s €1.5 billion capital raise. EQT, meanwhile, said SatPort Infrastructure will continue pursuing a standalone strategy to build a secure, operator‑neutral ground‑station platform.

Blue Origin Halts New Shepard Flights as Company Shifts Resources to Lunar and Heavy‑Lift Programs

New Shepard’s last mission, NS-38 lifts off from Launch Site One in West Texas on January 22, 2026. (Credit: Blue Origin)

30 January, 2026

Blue Origin will halt its New Shepard suborbital program for at least two years, redirecting staff and funding toward its human lunar systems, including the Blue Moon lander and the New Glenn launcher. The company framed the pause as support for U.S. goals to return humans to the Moon and establish a sustained presence, but the move effectively ends a program that has flown 38 missions, carried 98 people above the Kármán line, and launched more than 200 research payloads.

Although Blue Origin cites strategic reprioritization, reporting indicates the decision is widely viewed as a quiet wind‑down of suborbital tourism despite a multiyear customer backlog. This internal shift from short, commercially focused flights toward deep‑space infrastructure aligned with NASA’s Artemis program, signals a structural pivot rather than a temporary operational pause. With no defined restart plan or investment pathway for New Shepard, the shift may effectively sidelines suborbital tourism in favor of programs tied more directly to long‑term exploration goals. The announcement follows a NS‑38 mission days earlier.

Apolink Taps RBC Signals’ Global Ground Network to Support Planned In‑Orbit LEO Relay Service for Continuous Satellite Connectivity

Apolink will use RBC Signals’ global network of nearly 100 antennas across more than 60 sites as the ground endpoint for a cubesat demonstration launching on SpaceX’s Transporter‑17 mission in 2026. (Credit: RBC Signals)

30 January, 2026

In-orbit relay service startup, Apolink has partnered with RBC Signals, a ground station as a Service (GSaaS) to support a planned in‑orbit relay service aimed at reducing the long communication gaps most low Earth orbit satellites face when out of view of ground stations. The partnership plans to create an orbital data‑relay service for operators who can’t afford their own inter‑satellite links or dense ground networks.

At a practical level, Y-Combinator backed Apolink’s relay concept changes how operators move data off their satellites. Instead of waiting for the next scheduled ground pass, the company is proposing a simple, three‑layer chain that keeps spacecraft connected far more often than today’s ground‑only setups allow:

A customer’s satellite is out of view of any ground station. Normally it would be “dark” for 45–90% of each orbit.

Instead of waiting, it beams telemetry or commands up to an Apolink relay satellite in LEO. (Apolink’s demo is receive‑only S‑band at first.)

The Apolink relay forwards that data to Earth using RBC Signals’ global antenna network. RBC is the “last mile” teleport layer.

In the future, Apolink wants a full relay constellation so satellites can always reach some relay node, creating near‑continuous coverage.

In this model, RBC Signals functions as a reseller, packaging Apolink’s in‑orbit relay capability alongside its own global ground network as a unified service for operators. The startup will use RBC Signals’ global network of nearly 100 antennas across more than 60 sites as the ground endpoint for a cubesat demonstration launching on SpaceX’s Transporter‑17 mission in 2026.

Beyond this initial mission, Apolink plans a larger fleet designed to provide continuous telemetry, tracking and command coverage without relying solely on scheduled ground passes. The company says it has secured more than $150 million in customer commitments since its 2024 founding, targeting small operators, emerging constellations and sovereign programs seeking near‑real‑time connectivity.

The effort illustrates how commercial players pursue relay architectures to reduce dependence on ground infrastructure, following approaches already adopted by large constellations with proprietary inter‑satellite links.

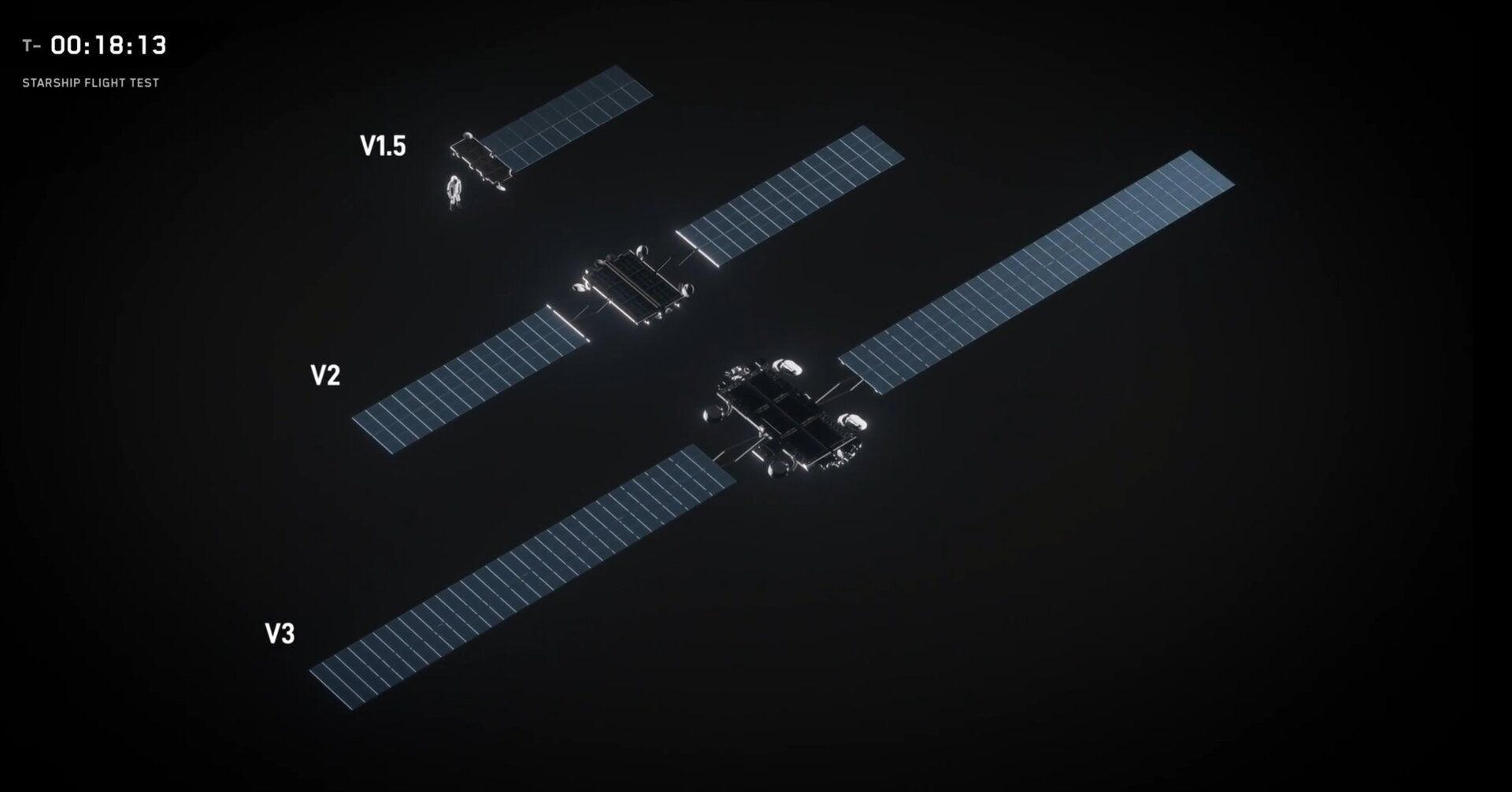

SpaceX Seeks FCC Approval for One Million-Satellites Orbital AI Data‑Center Constellation Amid Ongoing xAI Merger Talks

SpaceX aims to apply its Starlink constellation experience to the development of its proposed orbital data‑center network, which could include as many as one million satellites. (Credit: SpaceX)

31 January, 2026

SpaceX has filed an unusually expansive request with the U.S. Federal Communications Commission to deploy up to one million solar‑powered satellites designed to function as orbital data centers for artificial intelligence workloads. The exceptionally large orbital‑compute architecture would operate between 500 and 2,000 km, using optical inter‑satellite links to route compute tasks across a vast mesh that would eclipse the scale of today’s over 9,400 strong Starlink network. SpaceX positions the system as a response to accelerating AI‑compute demand and as a long‑term step toward more resilient, energy‑efficient infrastructure, though the one‑million‑satellite figure could be viewed as a negotiating ceiling rather than a realistic near‑term deployment target.

Launching a constellation of a million satellites that operate as orbital data centers is a first step towards becoming a Kardashev II-level civilization one that can harness the Sun's full power while supporting Al-driven applications for billions of people today and ensuring humanity's multi-planetary future amongst the stars.

The filing arrives as SpaceX and Musk’s AI company xAI engage in merger discussions ahead of a planned IPO, according to Reuters reporting. A combined structure would consolidate launch, broadband, AI model development and the X platform under a single corporate entity, potentially streamlining investment flows into space‑based compute capabilities.

The orbital‑data‑center proposal adds to the recent conversation of how major space actors frame future infrastructure. SpaceX argues that solar‑powered compute nodes in LEO could reduce terrestrial energy constraints and latency for distributed AI workloads. However, the challenges associated with regulation, debris management, and spectrum coordination, which are inherent in expanding to even a small portion of the proposed constellation size, remain significant. The FCC filing offers few details on deployment timelines, manufacturing capacity or customer demand, leaving open questions about whether the system is intended as a near‑term commercial product or a long‑range strategic placeholder.

Despatch Out. 👽🛸