Welcome back {{First_Name|Explorer}}🚀

Thanks for joining again. A well‑rounded week in science, governance and defense, with fresh updates in the commercial sector. Don’t forget the publication reads better on the link below. ⬇️⬇️

Let’s dive in.

IMAGES

Illuminated Shells of the Egg Nebula : Hubble Space Telescope

NASA’s Hubble Space Telescope has captured the illuminated shells of the Egg Nebula, a pre‑planetary nebula formed as a Sun‑like star rapidly sheds its outer layers. The object’s bright lobes and intersecting light‑scattering dust lanes trace episodic mass‑loss events that occurred as the star entered its final evolutionary phase. Jets and expanding outflows carve the nebula’s layered structure, revealing material ejected over the past few hundred years. The system is transitioning toward the planetary‑nebula stage, offering a detailed view of how dying stars shape their surroundings through pulsed winds, asymmetric outflows, and dense equatorial dust.

Located approximately 1,000 light-years away in the constellation Cygnus, the Egg Nebula features a central star obscured by a dense cloud of dust — like a “yolk” nestled within a dark, opaque “egg white.” It is the first, youngest, and closest pre-planetary nebula ever discovered. (Credit: NASA, ESA, Bruce Balick (UWashington))

Compass image of the Egg Nebula showing orientation and scale. (Credit: NASA, ESA, and STScI)

CubeSat Deployment : NASA Astronaut, Chris Williams

From the ISS cupola, NASA astronaut Chris Williams photographed a set of CubeSats as they were released from the Kibo module’s small‑satellite deployer. Students from Mexico, Italy, Thailand, Malaysia, and Japan designed the shoebox‑sized spacecraft for Earth‑observation and technology‑demonstration missions. CubeSats, a class of 1–10‑kilogram nanosatellites built to a standard form factor, have grown into a mature sector, enabling cost‑effective science, technology testing, and new mission concepts across government, industry, and academia. (Credit: NASA/Chris Williams)

Heart-Shaped Oasis of Faiyum, the Suez Canal and Cairo in Egypt : Copernicus Sentinel-2

SA’s Copernicus Sentinel‑2 mission captured a false‑colour mosaic of Egypt’s Nile Delta and the Faiyum Oasis, created from cloud‑free scans acquired between July and December 2025. Using the satellite’s near‑infrared channel, vegetation appears in red, revealing the Delta’s triangular agricultural footprint and the heart‑shaped Faiyum depression southwest of Cairo.

The contrast between irrigated land and surrounding desert highlights how Nile water shapes one of Egypt’s few arable regions, where fields of cotton, rice, and sugarcane form a patchwork of red tones. Urban areas, including Cairo, appear in grey, with the Pyramids of Giza visible on the city’s western edge. The image also traces the Suez Canal from Port Said to the Gulf of Suez. Faiyum’s oasis is fed directly by the Nile via the Bahr Yussef canal, with Lake Qaroun marking the remnants of a once‑larger freshwater lake. (Credit: contains modified Copernicus Sentinel data (2025), processed by ESA)

The Pyramids of Giza visible on the city’s western edge, at the center of the image. (Credit: contains modified Copernicus Sentinel data (2025), processed by ESA)

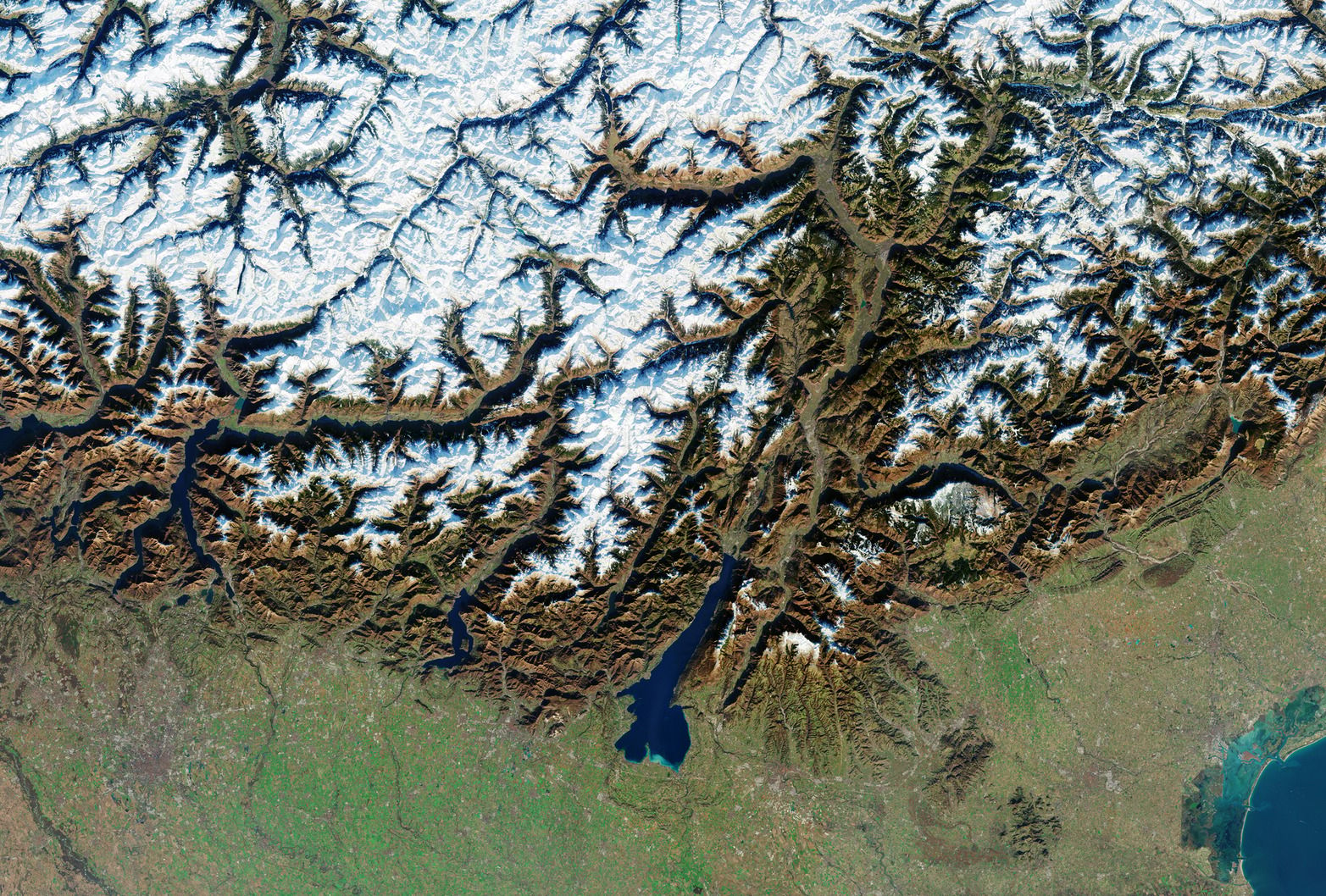

The Winter Olympics from Space : Copernicus Sentinel-2

ESA’s Copernicus Sentinel‑2 mission captured a cloud‑free view of northern Italy, highlighting the geographically dispersed venues of the Milano Cortina 2026 Winter Olympics. The Alps dominate the upper portion of the image, where most competition sites are located, including Bormio, Livigno, Anterselva, Cortina d’Ampezzo, Predazzo, and Tesero. Cortina, situated within the Dolomites UNESCO World Heritage Site, again serves as a major host after first staging the Games in 1956.

In the lower left, Milan appears as a dense grey urban area, with the San Siro Stadium hosting the opening ceremony. Central to the mosaic is Lake Garda, Italy’s largest lake, while farther east lies Verona, the site of the closing ceremony and home to the Roman Arena, which will also open the Paralympic Winter Games. The bottom right reveals the Venetian Lagoon, whose turquoise waters and island settlements mark the Adriatic coastline. Sentinel‑2’s multispectral data highlights terrain, water bodies, and urban form across the Olympic region. (Credit: contains modified Copernicus Sentinel data (2025), processed by ESA)

SCIENCE

New Australasian Space Innovation Institute to Consolidate Australia’s Sovereign Space R&D and Regional Partnerships

Credit: ASII

Australia is reorganizing its space‑research landscape with the launch of the Australasian Space Innovation Institute (ASII), an independent nonprofit designed to carry forward and broaden the work of the SmartSat Cooperative Research Centre, which concludes in June. SmartSat, backed by $270 million in government funding over six years, supported R&D across 170 universities and research organizations, producing intellectual property now being transferred to ASII for further development.

ASII is positioned as a long‑term mechanism to consolidate Australia’s sovereign space research capabilities and apply space‑derived data to national and regional priorities. Its “Flagship Programs of Impact” target precision agriculture, maritime surveillance, disaster response, and community resilience, while a parallel Indo‑Pacific initiative focuses on climate monitoring, security, and mobility. One planned effort with New Zealand involves a formation‑flying SAR constellation to reduce reliance on foreign systems and strengthen regional monitoring.

SmartSat CRC, created in 2019 under Australia’s Cooperative Research Centre framework, served as a major government‑funded vehicle for developing national space technologies and generating sovereign IP. With its six‑year mandate ending in June, the program’s most mature research outputs and partnerships are being transferred to the newly formed ASII to ensure continuity. ASII is expected to provide a permanent structure for advancing SmartSat‑developed technologies and applying them to national and Indo‑Pacific priorities.

ASII is also expanding partnerships across Southeast Asia, South Korea, Europe, and NASA centers, emphasizing downstream applications over satellite deployment.

Bennu Asteroid Samples and Planetary Chemistry Models Point to a Universe Rich in Organics but Poor in Habitable Planets

An illustration shows a young star encircled by a disk of gas and dust, the raw material from which new planets form. Whether those planets develop the chemical conditions needed for life depends on achieving the right oxygen levels during core formation. (Credit: NASA‑JPL)

Recent research is narrowing the conditions under which rocky planets can support life, suggesting that Earth’s habitability may stem from an unusually precise chemical balance during its formation.

New research from ETH Zurich argues that only a small fraction of rocky planets ever achieve the chemical conditions required for life, narrowing the range of worlds that can sustain biology. The team shows that the availability of phosphorus and nitrogen, which are elements essential for genetic molecules and proteins, depends on a narrow oxygen window during planetary core formation. If oxygen levels are too high or too low, these elements either bind to the core or escape, leaving planets that may sit in the habitable zone but lack the chemistry needed for life . Researchers also emphasize that long‑term habitability requires stable geochemical cycling and retention of key volatiles, conditions that appear uncommon across modeled planetary systems.

The findings, published in the journal Nature Astronomy, suggest that while many planets may form in seemingly favorable environments, only a small subset maintain the elemental balance necessary for life to emerge, positioning Earth as an outlier in planetary evolution.

A view of NASA’s OSIRIS‑REx spacecraft making brief contact on Oct. 20, 2020, with asteroid Bennu during its Touch-And-Go (TAG) sample‑collection maneuver, lifting a plume of dust and debris from the surface. (Credit: NASA)

New analyses of NASA’s OSIRIS‑REx samples from asteroid Bennu continue to expand the inventory of prebiotic chemistry available in the early solar system. Researchers report that the returned material contains a diverse mixture of organic compounds, hydrated minerals, and carbon‑rich grains, reinforcing earlier indications that carbonaceous asteroids carried water and life‑relevant molecules to young planets. The findings add weight to the view that the building blocks of biochemistry were widespread in the protoplanetary disk rather than rare local products of early Earth. Scientists note that Bennu’s composition closely matches some of the most primitive meteorites, suggesting that similar bodies across the solar system and likely around other stars, could have delivered comparable chemical packages. While the presence of these ingredients does not imply that life itself is common, the results strengthen the case that prebiotic materials were broadly distributed, even if only a small subset of planets could make use of them.

The findings of this study were published in the journal Proceedings of the National Academy of Sciences.

The studies together point to a dual constraint on habitability: prebiotic chemistry may be common in small bodies, but the planetary conditions required to preserve key elements and sustain long‑term surface stability appear highly selective. This emerging framework positions Earth not as a typical life‑bearing world, but as the outcome of an uncommon convergence of chemical and planetary factors.

New Modeling Defines the Physical Limits on Planet Size From Rocky Worlds to Gas Giants

One pathway for forming gas giants is core accretion, in which solid cores grow inside a protoplanetary disk by gathering rocky and icy pebbles until they become massive enough to pull in the surrounding gas around young stars. (Credit: Jean‑Baptiste Ruffio)

9 February, 2026

New modeling from UC San Diego researchers refines the upper limits of planetary size, showing that rocky worlds cannot grow indefinitely and that gas giants also face mass‑dependent constraints.

Gas giants are massive planets made primarily of hydrogen and helium. They contain dense cores but lack solid surfaces. Jupiter and Saturn are the solar system’s examples, though many larger gas‑giant exoplanets are known. At the upper end, the most massive gas giants begin to overlap with brown dwarfs, which are substellar objects sometimes described as “failed stars” because they cannot sustain hydrogen fusion.

The team used spectral data from the James Webb Space Telescope (JWST) to probe the HR 8799 star system, and has found that planets transition from rocky to gas‑dominated once they accumulate enough material for their gravity to retain thick hydrogen‑helium envelopes, placing a physical ceiling on “super‑Earths” and explaining why no rocky planets larger than roughly twice Earth’s radius have been observed. For gas giants, the study shows that adding mass eventually compresses the interior rather than increasing the planet’s radius, producing a size plateau seen in Jupiter‑class worlds.

The HR 8799 system lies about 133 light‑years away in Pegasus and hosts four massive planets, each roughly 5–10 times Jupiter’s mass. These worlds orbit far from their star, at distances between 15 and 70 astronomical units—meaning even the innermost planet circles HR 8799 fifteen times farther out than Earth orbits the Sun. The system resembles a scaled‑up version of our own outer solar system, with a chain of giant planets occupying wide, icy orbits similar to those from Jupiter to Neptune.

The work also suggests that extremely massive planets blur into brown dwarfs as fusion‑related processes begin to dominate. These findings help clarify why exoplanet surveys reveal distinct size populations and why certain theoretically possible planet types do not appear in nature. The research was published in the journal Nature Astronomy.

Researchers Chart One Million Cislunar and Earth‑Orbit Trajectories to Support Future Space‑Traffic Management

One of the million cislunar trajectories modeled by Lawrence Livermore National Laboratory researchers. The Moon’s orbit appears in light gray, while the spacecraft traces the colored path over the six‑year simulation. Earth and Moon not to scale. (Credit: Dan Herchek)

10 February, 2026

New work from California-based Lawrence Livermore National Laboratory (LLNL) uses high‑performance computing to simulate one million potential spacecraft trajectories/orbits in cislunar space, producing one of the most detailed dynamical maps of the region between Earth and the Moon. The models show how gravitational interactions from Earth, the Moon, and the Sun create shifting corridors, unstable zones, and long‑lived orbital families that differ sharply from the more predictable regimes of low‑Earth orbit.

Researchers at LLNL, a research institution focused on enhancing U.S. national security through advanced science and technology, emphasize that as civil, commercial, and defense activity expands beyond GEO, understanding these trajectories becomes essential for traffic management, mission planning, and long‑term situational awareness.

This mapping effort extends to Earth orbit more broadly, where congestion from satellites and debris is accelerating. By charting a million possible routes, researchers expect to identify regions where spacecraft can drift unpredictably, pathways that minimize collision risk and reveal where small maneuvers can trigger large positional changes.

Such models are necessary as commercial, civil, and defense activity expands beyond GEO, accurate dynamical forecasting will be essential for traffic management, mission planning, and long‑term space‑domain awareness. However, although the research findings and high‑level results are publicly released, the full simulation data, code, and supercomputing workflows are not openly available. That’s typical for work done on U.S. national‑lab systems, where the models may involve proprietary tools, export‑controlled components, or mission‑relevant analysis.

NASA Launches Two Missions from Alaska: One To Create CT Scan Of Auroral Electrical Currents, the Other to Study Black Auroras

A long‑exposure image captures the two Geophysical Non‑Equilibrium Ionospheric System Science sounding rockets, showing the first‑ and second‑stage motor burns. (Credit: NASA/Teik Araya)

10 February, 2026

NASA has launched two sounding rocket missions in three rockets from Alaska's Poker Flat Research Range to map auroral electrical currents. The Geophysical Non-Equilibrium Ionospheric System Science (GNEISS) mission deployed twin rockets simultaneously, flying side by side through the same aurora along different “slices,” on February 10. The rockets reached ~319-kilometer/198-mile altitudes, ejecting four subpayloads to create a three-dimensional CT scan of plasma beneath the aurora using radio signals transmitted to ground receivers.

Colorful ribbons of aurora sway with geomagnetic activity above the launch pads of Poker Flat Research Range. (Credit: NASA/Rachel Lense)

Meanwhile, the Black and Diffuse Auroral Science Surveyor (BADASS) mission launched a single rocket on February 9, climbing to 360 kilometers/224 miles to investigate black auroras, where electron flows reverse direction and shoot upward into space rather than toward Earth. Principal investigator Kristina Lynch from Dartmouth College described the approach as scanning all possible electron paths through atmospheric chaos shaped by collisions, winds, pressure gradients, and electromagnetic fields. The missions complement NASA's EZIE satellite constellation, launched March 2025, which measures auroral currents from orbit. Understanding these electrical circuits matters for protecting satellites and astronauts from geomagnetic storms that cause technical failures, power blackouts, and radio interference.

China Tests Mengzhou Crew Capsule and Reusable Long March 10 Booster in Integrated Flight Demonstration

The return capsule of China’s new‑generation Mengzhou crewed spacecraft is seen in the designated sea area on February 11, 2026, following a flight test. The same campaign included a low‑altitude demonstration of the Long March 10 reusable first stage and a max‑Q abort test of the Mengzhou system at the Wenchang launch site in Hainan. (Credit: Xinhua/Yang Guanyu)

11 February, 2026

China has carried out an integrated demonstration of two key elements of its future human‑spaceflight architecture: a prototype of the Mengzhou crewed spacecraft and a reusable first‑stage booster under development for the Long March 10 family. State media reports that the prototype Mengzhou spacecraft completed a suborbital flight and safe landing, validating systems intended for future crewed lunar missions. In parallel, the test showcased a reusable rocket stage that executed a powered descent and landing.

The uncrewed test prototype of the Mengzhou spacecraft ascended into the stratosphere atop the reusable Long March booster before firing its abort motors just over a minute after liftoff, at the point of maximum aerodynamic pressure (Max‑Q). The motors pulled the capsule clear of the booster to simulate an in‑flight escape from a failing rocket. Mengzhou then deployed parachutes and splashed down off Hainan Island.

The combined demonstration, i.e., launch, spacecraft separation, and booster recovery, mirrors integrated tests performed by commercial providers and signals China’s intent to accelerate reusability. The new spacecraft is expected to support both low‑Earth‑orbit and lunar missions, while the reusable booster is designed to reduce costs and increase launch cadence. The test highlights China’s effort to field a modernized, partially reusable system ahead of planned crewed lunar landings.

Analysis Shows Megaconstellation Growth Driving Sharp Increase in Uncontrolled Reentry Debris

12 February, 2026

Growing satellite megaconstellations are increasing the volume of material that will eventually reenter Earth’s atmosphere, raising questions about long‑term debris risk and the limits of current mitigation practices. A University of British Columbia study analyzing eleven “well funded”megaconstellations representing 73,369 satellites finds a 40% collective casualty risk from reentry debris if satellites fail to burn up completely. The research challenges assumptions about "design for demise" approaches, noting that materials like stainless steel, beryllium, titanium, tungsten, and silicon carbide commonly used in fuel tanks and reaction wheels resist complete ablation, unlike lower-melting-point aluminum.

More than 10,000 active satellites are now in orbit, with tens of thousands more planned, meaning routine reentries will become far more common as spacecraft reach end‑of‑life or fail prematurely.

The study, titled Satellite megaconstellations and collective casualty risks and published in the journal Space Policy, questions whether thousands of satellites are necessary, suggesting fewer, higher-capacity spacecraft with longer operational lives could reduce ground risks and atmospheric damage. Gaps in global regulation persist as operators are encouraged, but not universally required, to ensure safe disposal. Researchers recommend national regulators require independent verification of demisability claims, evaluate collective constellation risks rather than per-satellite assessments, and develop globally applicable controlled reentry standards. Current thresholds fail to account for cumulative effects when thousands of satellites reenter simultaneously, creating casualty risks to people, aircraft, and infrastructure while causing airspace closures.

GOVERNANCE

Germany Expands Lunar Ambitions as Bavaria Funds New Exploration Control Center and OHB Launches European Moonport Company

From left: Josef Aschbacher (ESA Director General), Anke Kaysser‑Pyzalla (DLR Executive Board Chair), Markus Söder (Bavarian Minister‑President), and Anke Pagels‑Kerp (DLR Divisional Board Member for Space). (Credit: DLR)

10 February, 2026

Germany is expanding its lunar‑exploration infrastructure and industrial footprint as the state of Bavaria commits €58 million toward a new Human Exploration Control Center (HECC) at German Aerospace Center’s (DLR) Oberpfaffenhofen campus, with DLR adding €20 million toward the facility’s €78 million cost. The center, integrated into the German Space Operations Center, will support European operations for Gateway and future lunar and Mars missions, replicating German Space Operations Center’s (GSOC) role in operating the ISS Columbus module. A new building for 200 staff is planned by 2030, alongside development of an expanded HECC Plus concept with multi‑mission and high‑security capabilities intended to serve customers beyond ESA.

The investment aligns with Germany’s broader strategy to lead Europe’s exploration agenda, following its €885 million pledge to ESA’s human and robotic exploration program, which is well above France’s €342 million and Italy’s €834 million.

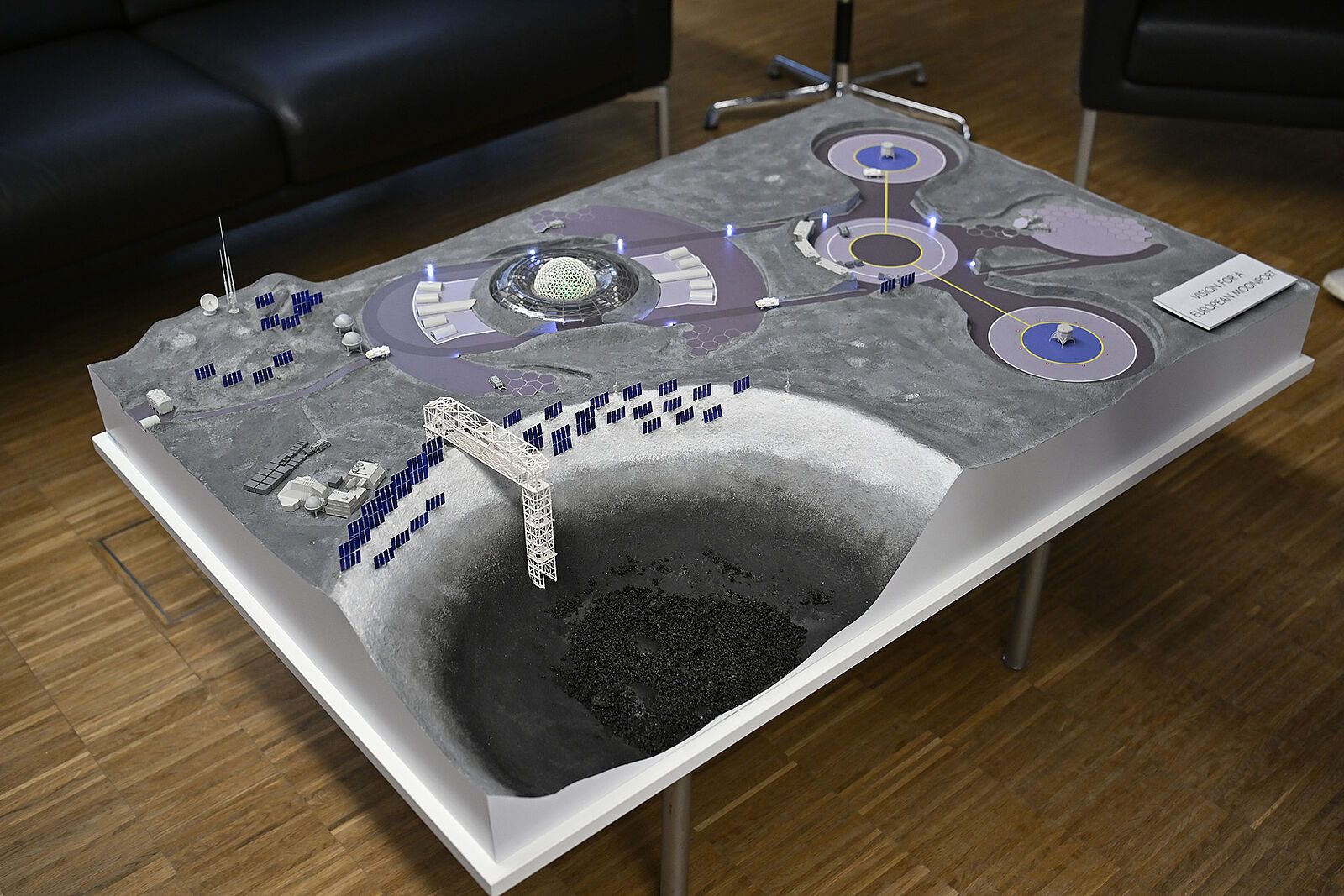

Model of the lunar infrastructure conceptualized by OHB and Munich Airport International.(Credit: OHB)

In parallel, Bremen-based space tech company, OHB has established the European Moonport Company, a new subsidiary intended to develop commercial logistics and surface‑operations capabilities for future lunar activity. The company will focus on transportation, landing services, cargo handling, and infrastructure support as Europe seeks to build a sustained presence on the Moon. OHB frames the initiative as part of a longer‑term strategy to position European industry for emerging lunar‑economy markets, including surface mobility, resource‑handling, and mission‑support services.

The new entity reflects Germany’s broader push to expand its role in human and robotic exploration, following increased national investment in lunar programs and growing industrial alignment behind long‑term Moon infrastructure. OHB’s move also complements ongoing European discussions about developing autonomous logistics chains and operational architectures for future missions, including contributions to NASA’s Artemis program and ESA’s planned lunar activities. The company expects the Moonport initiative to support both institutional and commercial customers as demand for lunar services grows.

US Senate Advances Revised Satellite Streamlining Act as FCC Pursues Faster Licensing and Spectrum Expansion

12 February, 2026

The U.S. Senate Commerce Committee has advanced the Satellite and Telecommunications Streamlining Act after revising provisions that would have automatically approved satellite applications if the FCC failed to act within one year. Lawmakers amended the “deemed granted” clause following concerns from Sen. Maria Cantwell that the original language could enable approval of extremely large constellations, such as proposals involving hundreds of thousands of satellites, without adequate review. The revised bill requires the FCC to establish eligibility criteria for automatic approval within two years, considering constellation size, orbital shells, spectrum use, interference risks, and whether systems involve novel architectures. Applications using federal or shared spectrum would be excluded. The FCC would also retain a 15‑business‑day window to approve or deny applications after a deadline is triggered.

The bill aligns with broader FCC efforts to modernize space regulation. At the SmallSat Symposium, FCC Space Bureau chief Jay Schwarz outlined an agenda to expand licensing capacity, introduce “shot‑clock” timelines (fixed deadlines that require an agency to act on an application within a set period), and create a “licensing assembly line” to handle rising application volumes. Schwarz said the FCC aims to simplify license modifications to reflect shorter satellite lifecycles and frequent fleet replenishment. The agency’s Spectrum Abundance proposal would make 20,000 MHz of additional spectrum available across multiple high‑frequency bands and explore new sharing frameworks with terrestrial systems. Schwarz also emphasized preparations for the 2027 World Radiocommunication Conference, where U.S. negotiators seek to secure favorable international spectrum outcomes.

The legislative revisions and FCC initiatives reflect mounting pressure to accelerate U.S. satellite licensing while preserving safeguards for interference, national‑security systems, and federal spectrum users.

Potential NASA–Roscosmos Leadership Meeting Emerges as Isaacman Plans Soyuz Launch Visit

NASA Administrator Jared Isaacman at a press conference after the Crew-12 launch February 13. (Credit: NASA / Kim Shiflett)

15 February, 2026

NASA Administrator Jared Isaacman signaled interest in reengaging directly with Roscosmos, saying he plans to attend the Soyuz MS‑29 launch this summer at Baikonur, which will carry NASA astronaut Anil Menon and Roscosmos cosmonauts Pyotr Dubrov and Anna Kikina to the ISS. If he attends, he would be the first NASA administrator at a Soyuz launch since 2018, when Jim Bridenstine witnessed the MS‑10 abort. Isaacman said NASA is preparing for a meeting with Roscosmos Director General Dmitry Bakanov, following last July’s brief leadership‑level contact during the Crew‑11 campaign.

Bakanov has previously expressed interest in expanding cooperation beyond the ISS, though U.S. sanctions limit joint activity. Isaacman emphasized that any discussions will remain focused on sustaining ISS operations. The potential Roscosmos meeting comes days after Isaacman’s first in‑person discussion with ESA Director General Josef Aschbacher, where both sides reaffirmed alignment on exploration priorities spanning the Moon, low Earth orbit, and Mars.

MILITARY

ThinKom Wins US Department of War Contract for Portable Ground Stations

Credit: ThinKom

9 February, 2026

ThinKom Solutions has secured a $3.9 million follow‑on contract to supply the U.S. Department of Defense with portable ground stations designed to provide tactical, resilient satellite connectivity without reliance on fixed infrastructure. The systems use the company’s VICTS (Variable Inclination Continuous Transverse Stub) mechanically steered phased‑array technology, enabling multi‑orbit, high‑throughput links in a compact, airline‑checkable form factor.

Each unit integrates multiple receive antennas connected to a digital beamformer, supporting rapid deployment for contested or austere environments. The award builds on earlier DoD evaluations of ThinKom’s portable terminals and reflects growing military interest in flexible ground architectures that can operate across commercial and government satellite networks. The company said the systems are intended to enhance mobility for deployed forces by enabling broadband connectivity for command‑and‑control, ISR data movement, and other mission applications. Additional deliveries and testing are expected as DoD expands its use of portable, multi‑orbit ground solutions.

US Reconnaissance Office Awards Imaging Contracts to Australian HEO, UK's SatVu, and Sierra Nevada

10 February, 2026

The U.S. National Reconnaissance Office has issued the first awards under its new Strategic Commercial Enhancements – Commercial Space Opportunities (SCE‑CSO) framework, selecting HEO, SatVu, and Sierra Nevada Corporation to provide emerging remote‑sensing capabilities. The contracts are structured as multi‑phase, multi‑year agreements intended to evaluate commercial systems for potential integration into NRO intelligence workflows.

Thermal imagery from SatVu’s HotSat‑1 reveals gas flaring, sub‑plant‑level refining activity, and hotter effluent water flowing into the sea at the Ruwais Refinery in the UAE. (Credit: SatVu)

Australia‑based HEO will supply non‑Earth imaging (i.e., up-close imagery of other satellites) and space‑based characterization data; UK‑based SatVu will provide mid‑wave infrared (MWIR) imagery for thermal monitoring by its HotSpot satellites; and Sierra Nevada will deliver radio‑frequency sensing and geolocation services. The awards mark the first tranche of a broader effort to diversify NRO’s commercial supplier base beyond traditional electro‑optical providers. NRO officials said the program is designed to assess data quality, tasking responsiveness, and operational scalability as commercial firms expand into multi‑phenomenology sensing. Additional awards are expected as the agency evaluates capabilities across RF, thermal, hyperspectral, and space‑domain awareness markets.

Integrate Secures $17 Million Series A to Scale Its Classified Collaboration Software for US Space Force Operations

12 February, 2026

Seattle‑based software startup Integrate has raised $17 million in Series A funding as it expands its classified‑collaboration platform across the U.S. defense sector. The company develops a secure project‑management system designed for distributed teams working on top‑secret programs, and is currently the only commercial platform deployed on the Joint Worldwide Intelligence Communications System (JWICS), enabling use on highly sensitive national‑security projects.

Integrate entered the defense market after winning a five‑year, $25 million Space Systems Command contract, one of the Space Force’s largest SBIR Phase 3 awards, supporting the Mission Manifest Office, which coordinates multi‑agency launch scheduling. The company previously worked with the Space Force under a 2023 SBIR Phase 2 effort.

CEO John Conafay said the new funding will expand engineering teams, strengthen tools for seamless work across classified environments, and advance AI‑driven risk‑analysis features. Integrate also plans to extend its technology into maritime, aviation, and automotive programs.

ULA’s Vulcan Centaur Delivers Two US Spy Satellites to GEO Despite Solid‑Rocket‑Booster Anomaly

The United Launch Alliance (ULA) Vulcan rocket lifts off from Space Launch Complex-41 on February 12 at 4:22 a.m. EST on a U.S. national security mission, known as USSF-87, for the U.S. Space Force's Space Systems Command (SSC). (Credit: United Launch Alliance)

12 February, 2026

A United Launch Alliance Vulcan Centaur launched the USSF‑87 mission on February 12, sending two spy satellites directly to geosynchronous orbit after a roughly 10‑hour ascent profile. The rocket flew with four solid rocket boosters, one of which showed an irregular burn pattern shortly after liftoff, similar to an anomaly seen on Vulcan’s second flight. ULA confirmed a “significant performance anomaly” on one motor but said the booster, Centaur upper stage, and spacecraft remained on a nominal trajectory. Space Systems Command also confirmed successful delivery while initiating a joint review before future national security missions.

The primary payload was a Geosynchronous Space Situational Awareness Program (GSSAP) space‑situational‑awareness system built by Northrop Grumman, used to monitor activity in and around GEO (22,236 miles/35,785 kilometers). The mission also carried a propulsive ESPA ring (EELV Secondary Payload Adapter, where EELV is Evolved Expendable Launch Vehicle): a ring-shaped adapter originally built to host secondary payloads on military launches, and in this case a Space Force research, development, and training spacecraft. The propulsive version adds its own power and maneuvering system. The ring will operate independently in GEO after deployment. The launch marked Vulcan’s fourth flight and its second under the National Security Space Launch program.

COMMERCIAL

Musk Says SpaceX Will Pursue a Self‑Growing Lunar City First as Mars Efforts Face Technical and Schedule Hurdles

Early conceptual renderings of cargo variants of human lunar landing systems from NASA providers SpaceX. (Credit: SpaceX)

9 February, 2026

Elon Musk has reversed his earlier stance that the moon was a “distraction,” stating that SpaceX will now prioritize building a “self‑growing city” on the lunar surface before pursuing human settlement on Mars. Musk said the moon is achievable within a decade, while Mars would require more than 20 years, citing faster launch cadence and shorter travel times as key advantages.

SpaceX has also abandoned plans for an uncrewed Mars mission in 2026, shifting resources toward a lunar landing demonstration targeted for March 2027. The pivot contrasts with Musk’s long‑standing Mars‑first rhetoric, including earlier claims that Starship would support thousands of launches per Mars window. The company has yet to demonstrate in‑orbit propellant transfer, a capability essential for both lunar and Martian missions. Musk said Mars remains a secondary objective, with initial city‑building efforts potentially beginning in five to seven years.

Aerospace Corp’s DiskSat Demonstration Spurs Commercial Licensing by Orbotic Systems and Satlyt for VLEO and In‑Orbit Compute

Engineers at The Aerospace Corporation’s El Segundo facility perform final checks on two completed DiskSats before shipment for the launch that happened in December 2025. (Credit: The Aerospace Corporation)

10 February, 2026

The Aerospace Corporation is advancing commercialization of its DiskSat platform as the first four ultra‑flat satellites, launched in December on a Rocket Lab Electron for the U.S. Space Force Space Test Program, complete commissioning. Southern California debris‑remediation startup Orbotic Systems and San Francisco‑based edge‑computing firm Satlyt have become the first commercial licensees, gaining access to the one‑meter‑wide, 2.5‑centimeter‑thick bus design.

Aerospace officials said partners can either license the architecture for independent production or collaborate on further technology development. Orbotic plans to deploy DiskSats in very low Earth orbit for space‑weather sensing using its Wind Ion Neutral Density (WIND) instrument, while Satlyt is exploring applications in autonomous operations, in‑orbit data processing, and distributed coordination. The Space Test Program is evaluating DiskSat power generation, communications, and environmental‑sensing payloads, following successful deployment of the four DiskSats from a custom dispenser to an altitude of about 550 kilometers. After commissioning, one spacecraft will descend into VLEO to demonstrate low‑altitude flight enabled by the platform’s reduced cross‑section.

Precision Refueling and Reusable Capsule Systems Progress With Spaceium’s Actuator Demo and The Exploration Company’s Nyx Trials

Two separate technology demonstrations this month highlight growing commercial interest in autonomous on‑orbit servicing and reusable spacecraft systems.

Spaceium robotic arm. (Credit: Spaceium)

10 February, 2026

In-orbit infrastructure startup, Spaceium has completed its first in‑orbit test of the precision actuator that will drive the robotic arm for its planned network of orbital refueling and repair stations. The actuator, flown on SpaceX’s Transporter‑15 rideshare, demonstrated 0.003‑degree rotational accuracy, a level the company says would translate to sub‑millimeter precision at the end of a five‑meter arm, far exceeding the performance of current space‑based robotic systems.

Spaceium, founded in 2023 and backed by a $6.3 million seed round after completing Y Combinator, views high‑accuracy fuel‑transfer mechanisms as central to enabling standardized cryogenic and non‑cryogenic refueling. The company plans a second mission later this year and aims to deploy its first operational stations within two to three years, capable of storing 10–30 metric tons of propellant for up to a decade. Longer‑term plans include inspection and repair services, though refueling remains the primary near‑term market focus.

The Exploration Company conducted January water‑impact tests using a 1:4‑scale model of its Nyx capsule. (Credit: The Exploration Company)

11 February, 2026

In Europe, The Exploration Company advanced its reusable capsule program with a series of splashdown tests for Nyx, its uncrewed orbital vehicle intended for cargo transport to low Earth orbit and, eventually, the Moon. Conducted in cooperation with the French Navy, the trials evaluated recovery procedures, flotation stability, and crew‑safety systems using a full‑scale test article.

The company previously completed heat‑shield trials and structural testing as it prepares for the Mission Possible orbital demonstration, currently targeted for 2026. Nyx is designed for partial reusability and modular payload integration, positioning the vehicle as a European alternative to U.S. commercial cargo systems.

Space Industry Repositions Around Mini‑Constellations, Orbital Data Centers, and Anticipated SpaceX IPO

10 - 12 February, 2026

At the SmallSat Symposium in Mountain View, California, held between February 10-12, 2026, executives and investors sketched a sector being pulled in two directions: the dominance of vertically integrated megaconstellations and the emergence of mission‑specific “mini‑constellations.” On a February 10 panel, Danish small-satellite manufacturer, Space Inventor’s Jan Smolders, EnduroSat USA CEO Rusty Thomas, and GomSpace North America CEO Slava Frayter said governments and large companies are increasingly seeking sovereign or customized systems of 30–200 satellites to avoid dependence on Starlink‑scale networks. Belgian manufacturer Aerospacelab’s Tina Ghataore noted that even 30 spacecraft can deliver rapid‑revisit imaging, while Terran Orbital CEO Peter Krauss argued that scaling production beyond bespoke satellites is now essential.

A separate February 10 discussion highlighted the structural pressures facing smaller operators as SpaceX and Amazon internalize more of the value chain. Deloitte’s Brett Loubert projected satellite counts could reach 100,000 to one million by 2035, driven partly by orbital data‑center concepts. UC Berkeley’s Abhishek Tripathi warned that such platforms blur the definition of “small satellite,” while analyst Armand Musey cautioned that deeper vertical integration will make it harder for independent operators to compete. Boston Consulting Group’s Charlotte Kiang saw room for standardized platforms and downstream services, though she expects continued consolidation.

On February 11, investors turned to the implications of SpaceX’s anticipated IPO, which panelists said could draw global capital into the sector while temporarily overshadowing other companies. Beyond Earth Ventures’ Patrick Beatty and DCVC’s Matt O’Connell predicted increased M&A activity, while KippsDeSanto’s Karl Schmidt warned that firms competing directly with SpaceX may struggle during the “vortex” of the listing. GH Partners’ Noel Rimalovski argued that SpaceX’s plan for up to a million orbital data centers could boost demand for non‑SpaceX launch providers.

A February 12 finance panel underscored that young space companies now have more exit routes and funding options. Craig‑Hallum’s Joe Dews pointed to expanded access to public markets and strategic acquisitions, while Promus Ventures’ Mike Collett noted that private capital can sustain companies far longer than in past cycles. In‑Q‑Tel’s Sara Jones emphasized the need for patient, government‑backed funding to bridge long development timelines, and Hogan Lovells partner Alexis Sáinz said durable revenue contracts are increasingly central to unlocking debt and institutional capital. New models such as satellite leasing, highlighted by Space Leasing International, reflect a sector broadening its financial toolkit even as public markets remain the deepest source of capital.

Stoke Space, China's iSpace, Eutelsat‑OneWeb, and Axiom Space Secure New Capital for Reusable Launch, LEO Satellite Procurement, and Commercial Station Development

The week’s round of space‑sector financing shows how capital is consolidating around reusable launch systems, next‑generation broadband constellations, commercial space stations, and China’s rapidly expanding private launch ecosystem.

A propellant tank takes shape on the production floor at Stoke Space’s Kent, Washington, factory. (Credit: Stoke Space Photo)

10 February, 2026

In the United States, Stoke Space extended its Series D round to $860 million, adding $350 million in new capital to accelerate development of its fully reusable Nova medium‑lift rocket and complete activation of Launch Complex 14 at Cape Canaveral . The company has now raised $1.34 billion to date and plans a first Nova launch later this year, supported by ongoing engine testing and expanded production capacity .

iSpace's Interstellar Return recovery vessel. (Credit: iSpace)

10 February, 2026

China’s private launch sector recorded its largest disclosed funding round to date as the launch firm iSpace announced a 5.037‑billion‑yuan (≈$700 million) D++ round, following a D+ raise in 2025. The syndicate included government industrial funds, provincial investment vehicles, and private equity firms, reflecting Beijing’s designation of commercial space as a strategic emerging industry. The capital will accelerate development of the reusable Hyperbola‑3 methalox launcher, expand assembly and testing capacity across multiple provinces, and support the company’s “land‑based launch, sea‑based recovery” model. iSpace has conducted recent fit checks and cryogenic tests but has not provided a revised launch timeline. The scale of the round highlights intensifying competition among Chinese firms, including Landspace, Galactic Energy, Space Pioneer, Orienspace, and Deep Blue Aerospace, to secure contracts for national megaconstellations such as Guowang and Qianfan.

11 February, 2026

In Europe, Eutelsat secured nearly €975 million/$1.1 billion in French‑backed export credit financing to procure 340 second‑generation OneWeb satellites, supplementing 100 already on order from Airbus Defence and Space. The financing package, guaranteed by Bpifrance Assurance Export, will support constellation replenishment as existing spacecraft reach end‑of‑life and is treated on par with Eutelsat’s other debt obligations. The deal highlights the capital intensity of maintaining a global LEO broadband network and the continued reliance on state‑supported credit structures for large‑scale satellite procurement.

12 February, 2026

In the commercial human‑spaceflight and infrastructure segment, Axiom Space raised $350 million in a mix of equity and debt to advance development of its commercial space station modules and next‑generation lunar‑capable spacesuits. The round was co‑led by Type One Ventures and the Qatar Investment Authority, with participation from multiple institutional investors. Axiom positions the financing as validation of its strategy to build the successor to the ISS while supporting NASA’s Artemis program through spacesuit development.

Amazon Leo Expands With Ariane 64 Deployment, Maritime Reseller Deals, Third‑Party Antenna Plans, and FCC Approval for 4,500 More Satellites

The Ariane 64 launch above Kourou, French Guiana on February 12, 2026. (Credit: Arianespace)

10 - 12 February, 2026

Amazon is expanding its low Earth orbit broadband strategy following the successful deployment of 32 Amazon Leo satellites on the debut flight of Europe’s Ariane 64 rocket from French Guiana. The mission marked Amazon’s first use of the four‑booster Ariane 6 variant. Amazon has launched roughly 180 of 3,232 planned satellites to date using SpaceX Falcon 9 and ULA Atlas V vehicles, but recently requested a two‑year FCC extension on its July deadline to orbit half the constellation. The company has contracted 18 Ariane 6 launches, making it Arianespace’s largest customer as the launcher targets up to eight flights this year. Arianespace is targeting up to eight Ariane 6 missions this year after four flights in 2025.

The FCC has approved Amazon’s request to deploy 4,500 additional Amazon Leo satellites, expanding its planned low Earth orbit constellation to roughly 7,700 spacecraft as the company accelerates efforts to compete with SpaceX’s Starlink. The authorization significantly enlarges Amazon’s Gen‑1 system, which aims to begin offering satellite internet service later this year. Starlink currently operates more than 9,000 satellites and serves about 9 million customers. The newly approved satellites will support broader global coverage, including polar regions, and expand available frequency bands for consumer and enterprise connectivity.

Credit: Amazon Leo

Meanwhile, the company also announced its first maritime broadband reseller agreements with MTN in the United States and ELCOME in the United Arab Emirates—both existing distributors of SpaceX’s Starlink—signaling Amazon’s intent to compete directly in mobility markets. Maritime users will be able to connect via Amazon’s Leo Pro antenna, offering up to 400 Mbps, or the Leo Ultra terminal, designed for 1 Gbps downloads. Amazon has not provided a firm service‑activation date, noting that mobility markets require denser satellite coverage than fixed broadband.

Amazon Leo also signaled openness to third‑party antenna integration, hinting at a more flexible ecosystem than earlier Kuiper plans. The company said it is evaluating interoperability with non‑Amazon terminals, a move that could broaden adoption across maritime, enterprise, and government markets.

Vast Secures NASA’s Sixth Private Astronaut Mission to the ISS, Breaking Axiom Space’s Winning Streak

The International Space Station. (Credit: NASA)

12 February, 2026

NASA has selected Vast to fly the sixth private astronaut mission (PAM) to the International Space Station, marking the first award to a company other than Axiom Space, which secured the first five PAMs and has flown four missions, most recently Ax‑4 in 2025.

The Vast mission will launch no earlier than mid‑2027 for a two‑week ISS stay and will use a SpaceX Crew Dragon under an existing agreement. Vast views the mission as a way to build operational experience ahead of its Haven‑1 commercial station, planned for launch in early 2027. NASA issued the call for PAM‑5 and PAM‑6 proposals in April 2025, awarding PAM‑5 to Axiom in January. Neither company has announced crews, which require approval from NASA and ISS partners. Axiom executives said demand for private astronaut seats remains high, with internal competition among its former NASA and JAXA astronauts to command the Ax‑5 mission.

RESEARCH SPOTLIGHT

Researchers Suggest Milky Way’s Central Mass May Be Dark Matter, Not the Sagittarius A* Black Hole

Artistic rendering of the Milky Way showing stars near the center orbiting at relativistic speeds around a dense dark‑matter core rather than a black hole. Farther out, the extended dark‑matter halo continues to shape stellar motions and the galaxy’s rotation curve. (Credit: Valentina Crespi et al.)

A new study published in Monthly Notices of the Royal Astronomical Society challenges the prevailing view that Sagittarius A* (Sgr A*), the 4.6-million-solar-mass object at the Milky Way's center, is a supermassive black hole, proposing instead it could be a dense clump of fermionic dark matter (a hypothetical form of dark matter composed of fermions).

Led by Valentina Crespi of the Institute of Astrophysics La Plata, the international team argues that ultra-light fermionic particles could form a super-dense core mimicking a black hole's gravitational pull, including the rapid orbits of S-stars reaching 30,000 km/s (~10% the speed of light), while its diffuse outer halo explains the Keplerian rotational decline observed by ESA's Gaia DR3 mission.

Unlike standard cold‑dark‑matter halos, the fermionic structure predicts a tighter, more compact profile that unifies the galaxy’s inner and outer dynamics. The authors note that according to a 2024 study such a core can also mimic the shadow‑like feature imaged by the Event Horizon Telescope. The team concedes current data cannot decisively distinguish between the two models, with the Very Large Telescope's upcoming GRAVITY interferometer identified as the key instrument to test predictions.

Despatch Out. 👽🛸